This article may contain affiliate links. I might earn a small commission if you make any purchases through my links and it comes at NO cost to you. For more information, please read my Disclaimer page.

Ever wondered why so many people struggle with budgets? Are you one of them? Well, if you are reading this article, my guess is you need help to track daily expenses.

You see, most budgets do not work primarily because of a couple of reasons:

- Your budget is either not created the right way OR

- You are not tracking your expenses daily

So, no matter how much you stress about your budget not working for you, it just won’t help!

How would you feel if you had to pass on buying that coffee table that you’ve been eyeing for months… once again?

OR

How disheartening would it be if you initially budgeted for visiting your parents but realized that you’ve blown through your budget and don’t have money to visit them?

In order for your money and budget to work for you, it is essential to track daily expenses. Most of the people wait until month end to record expenses and see how they performed vs. their budget. Well, that’s too late as you no longer have any control over the budget once the month is over.

So, a proactive approach would be to track daily expenses. This allows you to promptly make any changes and adjust your budget before the month-end.

1) Create A Monthly Budget Template

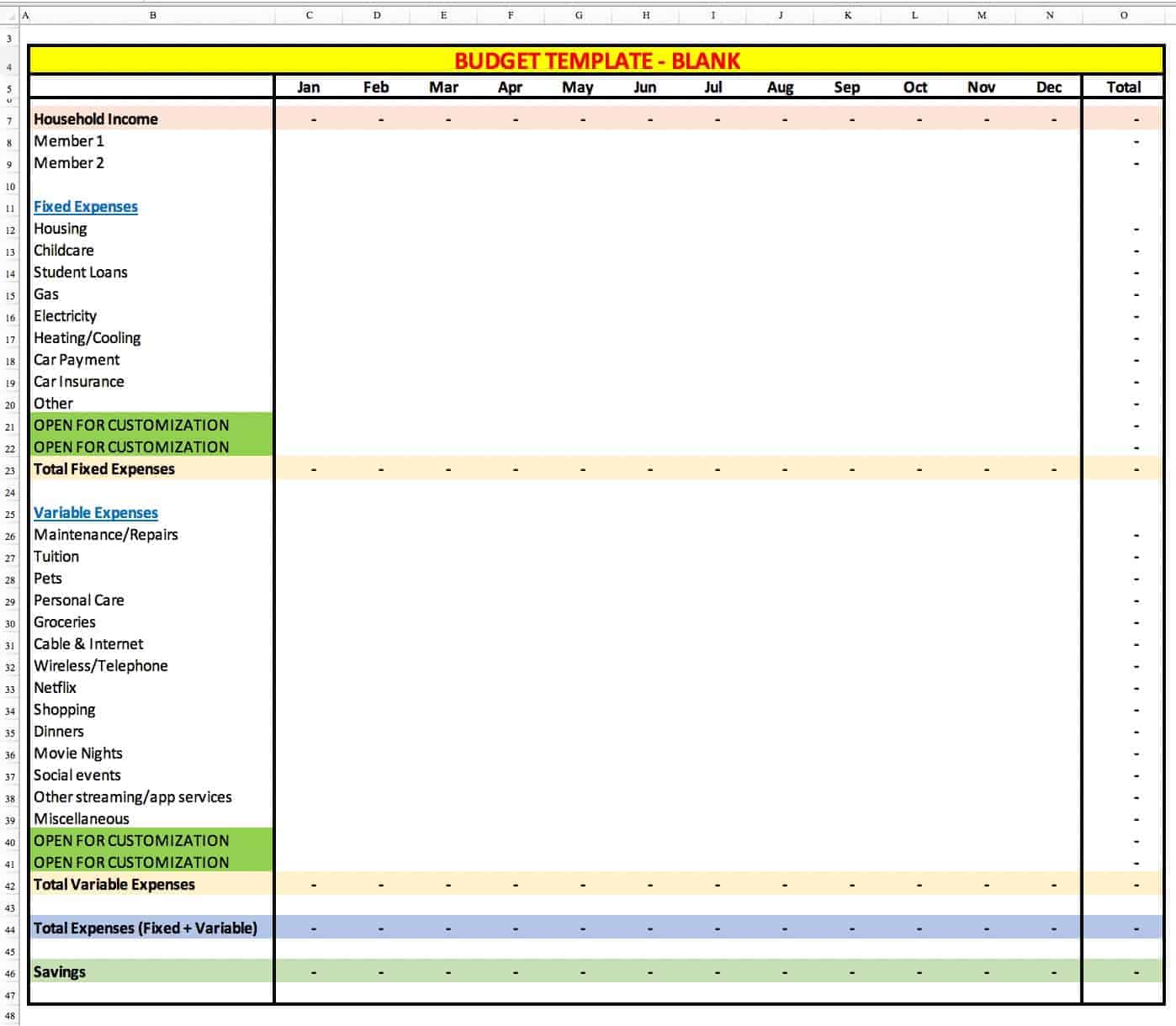

A budget template is something that helps you track your spending and gives you a monthly snapshot of your income, expense, and savings. So, this will lay the foundation for your budget process.

Create a detailed template where you can identify all sources of your household income, list all monthly expenses, and ultimately determine your savings.

Here’s how you can approach this:

- Plan out your total household income. This should include every source of income (regular or irregular) you earn in a given month. Include the income from all jobs (if more than one), monthly investment income or dividends, income from side gigs, tuition, music lessons, bar-tending, etc.

- Next, plan your fixed expenses. These are the necessities of life that you cannot live without and includes expenses for Rental, Mortgage, Childcare, Student loans, Gas, Electricity, Auto loans, and insurance, etc.

- Next, its time to plan those expenses that are not necessities. In other words, you can manage to either live without them or reduce your spending if need be.

A simple template like the one below should be good enough to put your numbers together.

2) Create A Daily Budget

Once you create a monthly budget template, break your monthly budget into a daily budget.

Why?

This will allow you to track daily expenses!

There are a couple of approaches to creating a daily budget:

- If you’d like a straightforward approach, then take your monthly budget and divide that by the number of days (For example, if your monthly budget for eating food outside is $300, your daily budget for food is $300/30 = $10)

- If you’d like to be more precise with your daily/weekly budgets, you can take the $300 from our example above and at first divide by weeks ($300/4 = $75/week). Then, you can divide $75 by the number of days you plan to eat out. If you only plan to eat outside 5 days a week, your daily budget is $75/5 = $15)

Download FREE Budget Checklist

>> 50+ List of Budget Items

>> Budget Items categorized into 3 sections: Income, Fixed Expenses, Variable Expenses

Remember, the deeper you dive into creating an accurate expense tracker, the better the chances of your budget working for you.

In order to align your expenses with your lifestyle, list all the expenses you incur on a daily basis. As you start tracking them, you’ll see how your expenses align with your daily budget.

If your daily expenses are running over your daily budget, you can quickly adjust the next day to get in line with your budget.

This will ensure that you are proactive about tracking daily expenses from the on-set.

3) Use Expense Tracking Apps

If you want to be one step ahead in tracking daily expenses you need to know your numbers (finances). Also, you need to be prudent about how much are you spending and where are you spending your money.

Countless folks I know, either do not have a budget or are not tracking their monthly spending. The easiest way to end up in a debt trap with no savings is to not track your daily spending.

I know what you must be thinking – track every purchase I make?

YES!

And there are countless tools/apps available to make your life easy.

Personally, I have tried recording the daily expenses in tables that I drew on notepads, using excel spreadsheets, the “notes” app on the phone, to using budgeting apps like Mint and good budget.

But a couple of years ago, I came across an app called the “Spending Tracker” It has 4.5+ stars and over 4,400+ reviews.

I gave it a shot and just fell in love with the user interface and simplicity of using the app. It is super intuitive and you will be an expert user in no time.

Download the app on iTunes here (not an affiliate link).

Download the app on Amazon here for Android (not an affiliate link)

Related Article: How To Save Money

FREE Daily Expense Tracker!

>> Your FREE 365-Day Tracker that can help you track daily expenses!

>> 12 monthly sheets for ease of tracking expenses

4) Plan For Surprises

Another important step to track daily expenses is to make sure you plan for surprises. In other words, you can anticipate most of the expenses you’ll have but not all.

There are always instances when you’ll have a couple of unexpected expenses knocking at your door.

Allocate a small amount every month for these surprises so you are not scrambling to find money when the expense actually hits. The goal here is to ensure you save money every month so make sure you do not let those surprises spoil the party!

For example, if you outsource lawn care and landscaping services during the spring and summer months, there could be times when you need more money for something unexpected.

Also, there could be some household expenses that pop-up during a month when you least expect.

So, instead of scrambling to find money at the last minute, planning ahead for surprises will really come in handy.

5) Track Your Performance

If there is one crucial link that holds your budget together, it’s about tracking your performance. In order for you to get better at tracking daily expenses, it is important for you to be consistent. It’s the best way to make your budget robust every month.

Compare your actual spend vs. what you budgeted and identify the categories and sub-categories that you either overspent or underspent.

Why?

So you can make the necessary adjustments to your expenses and be in line with your spending expectations moving forward.

Also, every month is different from an expense standpoint. For example, you do not need to budget summer camp expenses during winter months. So, keep in mind that your expenses will vary every month.

6) Make Necessary Lifestyle Adjustments

Once you start tracking daily expenses, you’ll soon notice a pattern/trend emerging. The trend would directly align with your personal habits.

For example, if you are an avid coffee fan, you’ll see coffee expenses on a daily basis. And sometimes, you’ll also notice that you spent more than what you had budgeted for.

So, when you are in a situation where you are spending more than budgeted, make the necessary life adjustments to align back with your budget.

This is another crucial step that brings you full circle with the process of tracking daily expenses.

Related Article: Money Mistakes To Avoid

7) Re-Allocate Unused Amount

Once you get the hang of tracking daily expenses, you will also notice that there are certain expenses you run favorable vs. budget.

In other words, if you’ve budgeted $20 daily for ongoing home maintenance or personal care, you might not be utilizing $20 on a daily basis.

So, you can re-allocate the excess amount from home maintenance to some other expense bucket. This is called adjusting your budget and daily expenses dynamically to align with your lifestyle.

Also, the next month you budget your daily expenses, you’ll have this important insight to adjust your expenses accordingly.

FREE Daily Expense Tracker!

>> Your FREE 365-Day Tracker that can help you track daily expenses!

>> 12 monthly sheets for ease of tracking expenses

BONUS TIP#

Track Daily Expenses With Long-Term Focus

If you push yourself to track daily expenses, it will become a habit after 66 days. Being consistent with anything for that matter will yield results – may it be studies, sports, business, gym or any area of life.

Another key budgeting tip is to have a long term focus. If you are pre-determined to just test it for a few days, it’s not going to help you.

Having a long term focus gives you and your budget enough time to make the necessary adjustments and bring your spending in control.

Similar to the fact that it would be almost impossible to lose 100 pounds in 5-10 days, the process of tracking daily expenses is also going to need some time.

The best way to learn is by making mistakes (which you will initially) with your daily expenses, so don’t beat yourself up and be patient.

Download FREE Budget Checklist

>> 50+ List of Budget Items

>> Budget Items categorized into 3 sections: Income, Fixed Expenses, Variable Expenses

Final Thoughts

You see if you want to take charge of your personal finances, tracking daily expenses is an important step.

If you push yourself and get into the habit of tracking your money, it will go a long way in managing your cash flow. I would like to stress again that the process is not an overnight success.

Once you track daily expenses consistently, it will become second nature. Also, you will have a process that works for your budget and won’t have to worry about a broken budget.

Make sure you incorporate the steps mentioned above to track daily expenses.

Do you track daily expenses? What process do you follow? Please share your experience, thoughts, tips, and ask away any questions in the comment section below!

Great article! So many great tips to remember when keeping a budget!

Thanks Alyssa!

Thanks for this informative post about tracking expenses. We generally use a website for our budget (moneysmart) and we allocate a fixed amount for various categories in our budget. Whatever we don’t spend goes to savings. Even the traditional pen and paper approach to tracking expenses works well, too, which is what I usually did when I was still living on my own.

Budgeting is a huge flaw in my expense life. How do I really stick to monthly or weekly budgets I make?

Don’t worry Francisca. You can always start budgeting today! Follow the steps outlined in the articles under the “budgeting” section on the website. I have shared some of the common tips that will ensure your budget works for you. Thanks!

This is a great post on budgeting because you provide steps that are easy to follow. I use Calendar Budget and I’m fanatical about recording everything I buy. That helped me with taxes this year. Now, when it comes to sticking to a budget I’m bad.

Thanks Heather!

This is so helpful! I am the one that always says she will track her expenses at the beginning of the month and ends up with a blank sheet at the end. I’m going to try your tips consistently for the month of April and budget in a reward at the end of April if I can follow through. Thanks!

Impulse buying is my main problem.

Thank you for this article.

Indeed thats a challenge. Thanks Lydiah!

This is such a helpful post! I can be hard trying to track groceries when you love clean healthy foods! It’s a great way to take out cash, so that you don’t go over budget!

Thanks Amanda!

I like your tip 4! Plan for the surprises is very important and this is the point people always overlooked! Thanks for reminding me again!

Thanks Hannah!

really great tips thanks for sharing

Thanks Jimmy!

Great read! Thanks for sharing!

Thanks Christina!

These are great tips! I definitely need to get back to budgeting!

Thanks Lauren!

This is an easy to follow process that anyone who wants to get on track with their finances can incorporate.

Thanks DeShena!

Great tips! My wife and I have completed a monthly budget using a zero-based template I created years ago in Excel. It’s funny I stumbled upon this post this morning because we’re actually giving a version of this template away as a freebie in our newest post at the moment. We sit down every Friday night and plugin every expense that was made for that week. Keeping a monthly budget has been a game-changer for our family financials, and updating weekly gives us the opportunity to adjust fire if necessary.

I believe the expense tracking apps can definitely be beneficial, but I’ve never bought into any of them personally. By using Excel I’ve been able to compile years of monthly variable expenses and forecast out with accurate averages. I’m always fearful that if I just use an app that one day the app will be no more, and my historic data will go away with it.

That’s excellent Joe! Thanks for sharing!

These are great tips! Thank you!

Thanks Jennifer

This is an awesome post! I started tracking my expenses back in January of this year for a no-spend month, and it was a game changer!!

Make Life Marvelous

Glad you found it helpful Ashley!

Hey Sam,

What a useful article. Opened up my eyes on what I can improve on. Will definitely bookmark this read for future references !

Cheers.

Thanks, Dane! Glad you liked it!

Hey Sam,

Resources you provided are awesome and great tips too.

Thanks Shanthi!