This article may contain affiliate links. I might earn a small commission if you make any purchases through my links and it comes at NO cost to you. For more information, please read my Disclaimer page.

Would you enjoy a Debt-Free Living? I certainly would, and I’m sure you would too!

Imagine Scenario #1 – you’ve worked hard to get into a good college and pursue a degree you’re interested in. You continue to study hard, put in the hours for good grades and FINALLY, the day comes… when you graduate!

Fantastic feeling, isn’t it?

Imagine Scenario #2 – you are tired of paying that crazy amount of rent for a cardboard size apartment space. And, you finally decide to start saving to buy your first home. Fast forward a few years and the day has come when you buy your dream home!

Unmatched adrenaline running through your veins and you are ecstatic about your purchase, correct?

While in both scenarios above, there is no question that your hard work, planning, sacrifices have paid off, you are now on the hook to pay off your student debt and mortgage.

If you are not able to pay your monthly dues toward your student debt, your credit history will suffer and the government can garnish your wages (meaning, they can go into your bank accounts and take money).

And, if you are not able to pay your mortgage, you will be kicked out of the house.

So, in order to achieve debt-free living, you need to plan ahead. You not only need to pay off your debt on time but also save enough to achieve financial independence.

Now, lets take a look at these 10 ways to achieve debt-free living.

1) Create An Action Plan

An action plan is a plan with steps you’ll be taking to achieve your goal(s).

You must create an action plan on how are you going to achieve debt-free living. I highly recommend not to wing it and make haphazard payments to your accounts.

Create a detailed plan where you can identify all sources of your household income, list all monthly expenses, and ultimately determine your savings.

Here’s how you can approach this:

- Chalk out your income, expenses, and savings every month.

- Next, you want to layer in your debt from each account (student loans, credit cards, etc.)

- Determine if the amount you are saving is enough to cover the monthly debt payments.

- If yes, that’s great! If not, you’ll have to find innovative ways to either reduce your expenses or increase your sources of income.

2) Create A Monthly Budget

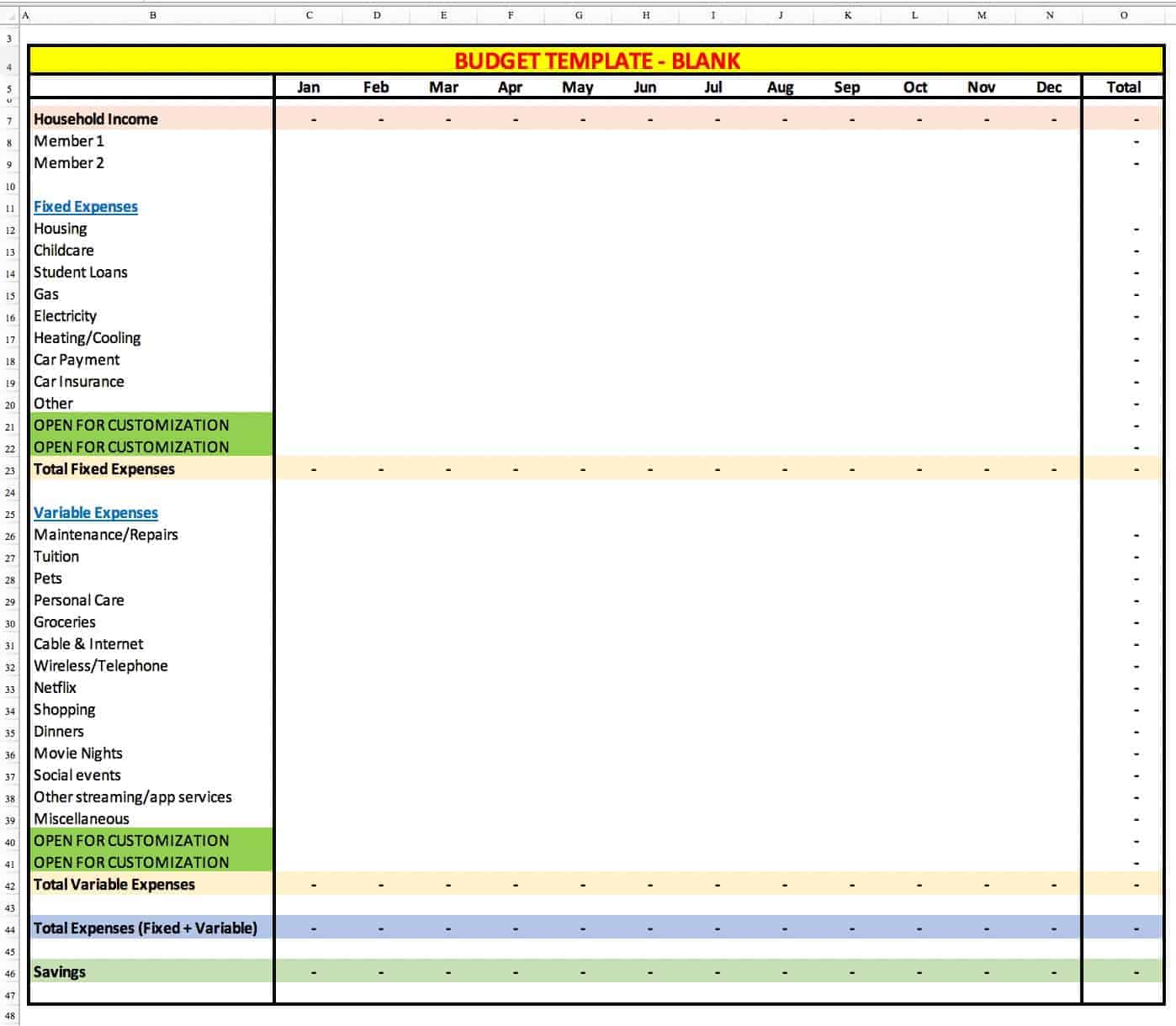

A budget template is something that helps you track your spending and gives you a monthly snapshot of your income, expense, and savings. So, this will lay the foundation for your budget process.

Create a detailed template where you can identify all sources of your household income, list all monthly expenses, and ultimately determine your savings.

Here’s how you can approach this:

- Plan out your total household income. This should include every source of income (regular or irregular) you earn in a given month. Include the income from all jobs (if more than one), monthly investment income or dividends, income from side gigs, tuition, music lessons, bar-tending, etc.

- Next, plan your fixed expenses. These are the necessities of life that you cannot live without and includes expenses for Rental, Mortgage, Childcare, Student loans, Gas, Electricity, Auto loans, and insurance, etc.

- Next, its time to plan those expenses that are not necessities. In other words, you can manage to either live without them or reduce your spending if need be.

A simple template like the one below should be good enough to put your numbers together.

3) Earmark Your Money

This step will hold your entire strategy of debt-free living together. Here’s what I mean by that…

I’m going to assume that most of you have heard about Budgets. There is ample information, both good and bad on the internet about the budgeting process and budgets in general.

I have been in Corporate Finance, working with companies on their budgets, forecasts, strategic plans, and business partnerships for close to 15 years.

So, here’s my take on Budgets…

Most medium-sized companies and almost all big companies have yearly budgets.

Why?

Because budgets are a tool that you can use to both create a plan of action and use it as a guideline for your future.

Download FREE Budget Checklist

>> 50+ List of Budget Items

>> Budget Items categorized into 3 sections: Income, Fixed Expenses, Variable Expenses

The beauty of earmarking your money (you can also call it budgeting) is that you know exactly how much you planned to spend.

Consider yourself as a business entity that needs to plan for its finances, make income, pay for expenses, save, pay off your debt, and student loans and invest in its future.

It’s not any different from that.

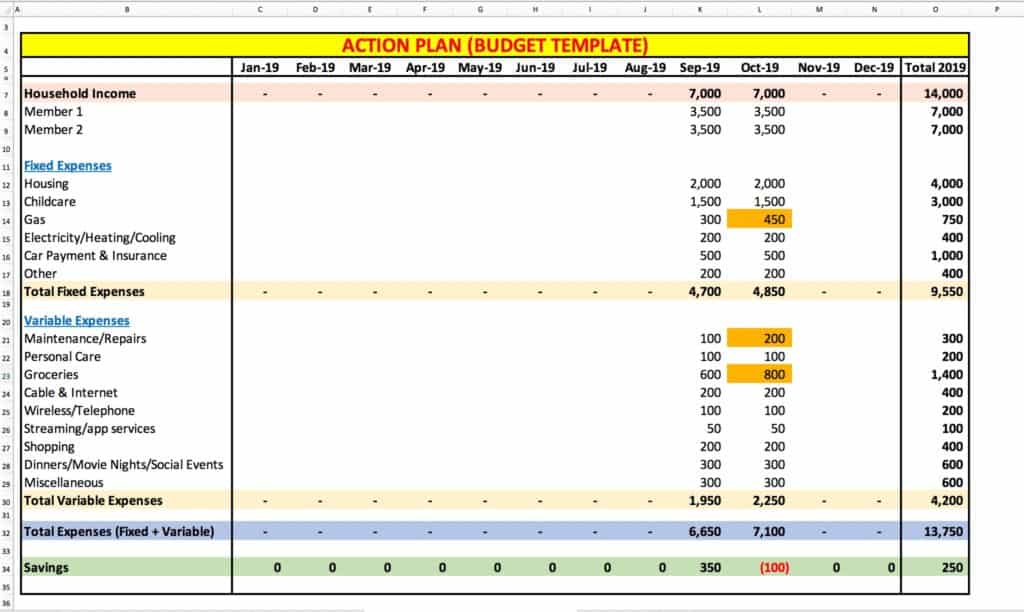

Based on your monthly income and expenses, earmark dollars against each of the categories in the Action Plan template (Step 1)

It might look something like this…

As you can see, you have your income, fixed expenses (one that you need to pay and can’t live without), and variable expenses (that you can make adjustments to) earmarked per month.

September – you plan to save $350

October – you are going to overspend by $100 (categories are highlighted in orange)

The above insight helps you take a proactive approach (especially for October) and figure out a way to save.

4) Create A Daily Budget

Once you create a monthly budget template, break your monthly budget into a daily budget. This is one of the most important debt-free living tips.

Why?

This will allow you to track daily expenses!

There are a couple of approaches to creating a daily budget:

- If you’d like a straightforward approach, then take your monthly budget and divide that by the number of days (For example, if your monthly budget for eating food outside is $300, your daily budget for food is $300/30 = $10)

- If you’d like to be more precise with your daily/weekly budgets, you can take the $300 from our example above and at first divide by weeks ($300/4 = $75/week). Then, you can divide $75 by the number of days you plan to eat out. If you only plan to eat outside 5 days a week, your daily budget is $75/5 = $15)

Remember, the deeper you dive into creating an accurate expense tracker, the better the chances of your budget working for you.

In order to align your expenses with your lifestyle, list all the expenses you incur on a daily basis. As you start tracking them, you’ll see how your expenses align with your daily budget.

If your daily expenses are running over your daily budget, you can quickly adjust the next day to get in line with your budget.

This will ensure that you are proactive about tracking daily expenses from the on-set.

FREE Daily Expense Tracker!

>> Your FREE 365-Day Tracker that can help you track daily expenses!

>> 12 monthly sheets for ease of tracking expenses

>> Customized for every year and no updates required

5) Track Every Dollar You Spend

If you want to avoid the debt trap and enjoy debt-free living, you need to know your numbers (finances). Also, you need to be prudent about how much are you spending and where are you spending your money.

Countless folks I know, either do not have a budget or are not tracking their monthly spend. The easiest way to end up in a debt trap with no savings is to not track your daily spend.

I know what you must be thinking – track every purchase I make?

YES!

And there are countless tools/apps available to make your life easy.

Personally, I have tried recording the daily expenses in tables that I drew on notepads, using excel spreadsheets, the “notes” app on the phone, to using budgeting apps like Mint and good budget.

But a couple of years ago, I came across an app called the “Spending Tracker.” It has 4.5+ stars and over 4,400+ reviews.

I gave it a shot and just fell in love with the user interface and simplicity of using the app. It is super intuitive and you will be an expert user in no time.

Download the app on iTunes here (not an affiliate link).

Download the app on Amazon here for Android (not an affiliate link)

6) Know How Much You Save

If you’re not saving anything every month, the answer is pretty simple. But if you are, you need to determine if that is enough.

Your ticket to financial independence is buried in this one question. If you are not diligent about the amount you save every month, it will feel like an eternity before you have enough saved. Needless to say, debt-free living will remain a dream forever.

So, set a monthly amount you would like to save based on your total income and total spend.

Once you decide, revisit your spending and figure out where can you make the sacrifice to save extra. If you can’t afford to eat lunch outside every day, brown bag your lunch.

If you can’t afford $4 coffee every day, start making your coffee at home.

Related Article: 25+ Creative Ways To Save

7) Pay-Off Your Credit Card Debt

These days, the credit card issuing companies have less stringent rules giving the steep competition.

What does it mean for you and me as a consumer?

It means that we can get a higher credit line than what we are either looking for or can afford to spend. So, it’s a double-edged sword in that we get to use more credit but also have to pay the balance at the month-end.

A lot of credit cards have Travel, Gas, Shopping benefits linked to the reward points you accumulate. This means you can either get cash back or redeem the points to pay off your monthly balance.

There are a ton of benefits that come along with using a credit card, so be smart about using credit cards.

It goes without saying, the higher your credit card usage, the higher your monthly balances you need to pay off.

If you are tracking your monthly usage and keeping it in line with your budget, kudos to you!

Download FREE Budget Checklist

>> 50+ List of Budget Items

>> Budget Items categorized into 3 sections: Income, Fixed Expenses, Variable Expenses

But, if not (and unfortunately, a lot of folks don’t track) you’ve got a problem! This is one of the common money mistakes to avoid in order to achieve debt-free living.

If the monthly payoff balance is higher than what you can pay, by default you will have to wait until you have enough money to clear the balance.

The credit card company will add interest to your purchases (since you did not pay the balance when it was due) and now the payoff balance is higher.

And, this becomes a vicious cycle until you make full payment.

Instead, be meticulous about your credit card usage every month and don’t overspend. You’ll both enjoy the benefits and also build your credibility/credit score as time goes by and achieve your goal of debt-free living.

Related Article: How To Use Your Credit Card Wisely

8) Pay-Off Your Student Loans

Student loan debt has been increasing at a staggering pace in the past decade. More and more students are graduating with higher student loans and struggle to save money.

So, for a graduate fresh out of college, debt-free living seems like a distant planet.

According to Investopedia, there was a research study by The College Board in 2019, and here are the findings:

- Total outstanding student debt reached $1.4 trillion in 2019

- The average student loan balance per borrower also hit a record high of approximately $36,000

- 54% of students borrow money (get in debt) in the form of student loans and(or) pay for other college expenses

Think about the above statistics for a moment…

Right out of the gate, the college graduates are being set up for failure. The jobs out of college do not pay nearly enough to cover rent, food, car, insurance, student loans, and other necessities in life.

This leads to more borrowing through credit cards and it becomes impossible to save and invest your money.

So, if you have student loans, pay it off as soon as you can before saving for anything else.

FREE Daily Expense Tracker!

>> Your FREE 365-Day Tracker that can help you track daily expenses!

>> 12 monthly worksheets for ease of tracking expenses

>> Customized for every year and no updates required

9) Create An Emergency Fund

Building an emergency fund is key to saving money and debt-free living.

How?

If you do not have an emergency fund, in case of emergencies, you will have to dip into your hard-earned savings to cover expenses. This will lead to reduced savings instead of the other way around.

Given the very nature of emergencies, no one would willingly ask or wish for it, yet, most of us ignore planning for it and creating a separate fund that can be a life savior in those difficult times.

I was guilty of doing the same until I got my act together and consciously started setting aside money for emergencies.

Related Article: How To Create An Emergency Fund

FREE Emergency Fund Tracker!

Life is full of surprises, so why not build an emergency fund that can help you when you need it the most. Learn how to build a $1,000 fund in 77 days.

10) Focus On Investing

Back in my 20’s, I used to have a lot of questions regarding money & investments:

- What are the best investments for a beginner?

- How can I get the best return?

- Will my money be safe?

- How do I make my money work for me?

- In the event, an institution commits fraud, what happens to my investments?

- How can I trust a big bank or an investment firm with my money?

You get the point – I was very skeptical about trusting someone else with my money!

As the years went by, I have also heard countless folks asking similar questions. Over the past couple of decades, there has been a significant shift in not only the investing options available but also in the way we invest.

Artificial intelligence is now beginning to play a role in investment decisions and recommendations made by many experts and industry gurus. These days, automated robo advisors can predict market moves and provide suggestions to align your portfolio with economic and market conditions.

So, the million-dollar question – If you are just getting started, where should you invest your hard-earned money?

As a millennial who experienced the 2008-2009 Global Recession, I was somewhat clueless and skeptical.

My approach was: One step at a time!

Before you take a deep dive, I’d suggest you carefully read and understand the below 3 key aspects of investments: Compounding, Risk Appetite & Diversification.

Related Article: How To Invest Money

Download FREE Budget Checklist

>> 50+ List of Budget Items

>> Budget Items categorized into 3 sections: Income, Fixed Expenses, Variable Expenses

Final Thoughts

If you are striving for a debt-free living, the ideas shared above are going to lay a strong foundation for your journey.

From student loans to credit card debt to your mortgage being paid off, at every instance of your life, you need to have a financial plan in place to tackle surprises.

The more disciplined you are about sticking to your plan, the quicker you can achieve a debt-free living. Also, it’s a great feeling not to owe someone money!

What are your thoughts on debt-free living? What process do you follow? Please share your experience, thoughts, tips, and ask away any questions in the comment section below!

Great post! It’s always my goal to live debt-free but it’s so easy to get caught in the trap. I think you offer some amazing ideas for self-discipline.

Thanks Shire!

Great, thorough post of scenarios and options. Good read!

Thanks Jackie!

So many people create a goal, but never follow through. I wrote down I wanted to invest in stocks two years ago and now I own dozens. The only way you will master something is by doing. Thanks for the post.

So true Ivana. Thanks!

Useful tips. We all know about all of these, but often fail to implement all simultaneously. It’s good that you have put together the whole picture together on this post, including investment – because I agree that investment is a key aspect of financial growth which many often overlook while planning money.

Indeed Pubali! Thanks for sharing

This was a good list to help people get started on becoming debt-free. It definitely takes time and dedication, but it is worth it. We paid off our mortgage in March and are now 100% debt free, and the feeling and peace are indescribable.

That’s great news Kaitlyn! Congratulations and thanks for sharing!

Great post! Very thorough. It is so crucial to build and stick to a budget. Thank you for sharing.

Thanks Tiffany!

Great Post! Thanks for the step by step guide and the free download!

Glad you liked it Cathy!

Thank you for this blog post. I have been trying to reach being debt free fir the last few years. It seems like everytime I get close a big unexpected expense pops up and I have to whip back out the credit card. It can be very frustrating but if I follow your tips and build my emergency fund I think I can get it done!

Absolutely Janette! Building a fund that can help you protect your savings and CC expenses is critical to your financial progress. I have some helpful resources in the website for creating your first $1,000 fund so check it out if you like. Thanks!

“Track Every Dollar You Spend”

That’s been the most important part for me. Knowing where and when my money does out allows me to adjust my patterns.

Thanks for the post!

Thanks Nick!

Great tips! I wish I had this info back before I went to college because I, like so many others, ended up in student loan and credit card debt just trying to get through college.

Thanks for sharing George! Hope these tips help you in your journey toward financial freedom!

This is a great list for anyone who wants to get started on getting rid of debt! Thanks for posting

Thanks Anum!

Hi Sam,

Do you think there is such a thing as “good debt?” Do you believe in using leverage to multiply your investments or is it not worth the risk?

Thanks Marco! I do believe in leveraging and taking risks but keep in mind that everyone has a different risk appetite. To me its no different than investing in yourself through education and leveraging student loans to help you build a better future. I’d recommend determining a set amount or percentage you are willing to leverage and NOT exceeding that threshold (even during good days). Hope that helps!

We are a debt free family and I can these tips are spot on. Telling your money where to go is so important. Thanks for these great reminders.

Thanks for sharing Lina! Congrats on being debt free!

I needed this! I don’t earn much and I’m already in debt. I will pay my debts before this year ends and more loans next year and years after *fingers crossed*

Glad you found it helpful Meredith!