This article may contain affiliate links. I might earn a small commission if you make any purchases through my links and it comes at NO cost to you. For more information, please read my Disclaimer page.

So, you’ve decided to put a plan (budget) in place to manage your money. OR, you’ve totally given up on budgets as they do not work for you.

Kudos to you for taking the first step toward achieving financial independence by thinking about budgets. As many make it sound, the process of budgeting is not complex. If you have the right guidance and resources, it is pretty straightforward.

Think of your budget as a lighthouse guiding you through the path to financial freedom. It’s all about knowing where your money is coming from and where does it go.

Once, this idea of tracking your money becomes second nature, your budget will become your BFF (best friend forever) in your financial journey.

Whether this is your first take toward budgeting or you want to start over again, these 10 budgeting tips will set up a strong foundation for your budgeting process.

10 Budgeting Tips To Manage Your Money

1) Why Are You Budgeting

Your reason for budgeting and managing your money is the driving force that will ensure the continuity of the process. To me, this is the most important of all budgeting tips.

If you are budgeting because someone told you to or you read it somewhere that it is good for your finances, chances are you will not be consistent and the process won’t help you.

Instead, think about the end goal you’re trying to reach. Align the budget process with your burning desire to become debt-free, save more, invest and grow your money. No matter what your end goal is, your reason to budget should inspire you.

One of the other reasons why people budget is to solely get their spending habits under control. Another reason is to pay off student loans or credit card debt or both. Or, maybe you are getting married or having a baby.

See the point?

Once you align your budgeting process to your end goals, you will be amazed by how your spending habits will change and fall in line with your goals.

2) Choose The Right Budgeting Method

Selecting a budgeting method that works for you and your household is of utmost importance. Do not choose a budgeting method because it is more popular. Personally, I am a fan of this budgeting tip!

There are 4 main types of budgeting methods:

- 50/30/20 Budget: This is the most straightforward budgeting method. The idea is to segregate your expenses into 3 categories: 50% for all your needs, 30% for discretionary and 20% for paying off debt and saving.

- Zero-Based Budget: One of the most popular methods is a zero-based budget. In this method, your budget at the end of the month should be zero. Meaning, every expense that you anticipate is assigned a category and planned for. This reduces the room for error.

- Envelope Budget: This method is similar to the zero-based budget except that it only deals with cash. You allocate cash for your monthly expenses into envelopes. For example, if you allocate $600 for groceries, you put $600 cash into an envelope and only use that envelope for grocery shopping.

- Pay-Yourself First Budget: In this method, you pay yourself a set percentage or amount first from the income you receive. This ensures that you have some savings at the end of the month.

If you are budgeting to pay off your debt, save money or want to invest and grow your money, the zero-based budget method is the one.

Why?

Because it is a detailed method that will not only give you valuable insights into your spending habits but also aligns your money with your long term financial goals.

Related Article: What Is A Zero-Based Budget

You can also download my FREE Budget Checklist to get started or click on the below box to download.

3) What Is Your Monthly Spend

In order for your budget to work for you, the inputs you provide during the planning process are critical. Of all the budgeting tips, this one holds the entire budget process together.

Remember, garbage in, garbage out!

In other words, you should have a good understanding of your income and expenses. This will ensure that your budget is more accurate, to begin with. The more detailed your approach, the more accurate your budget will be.

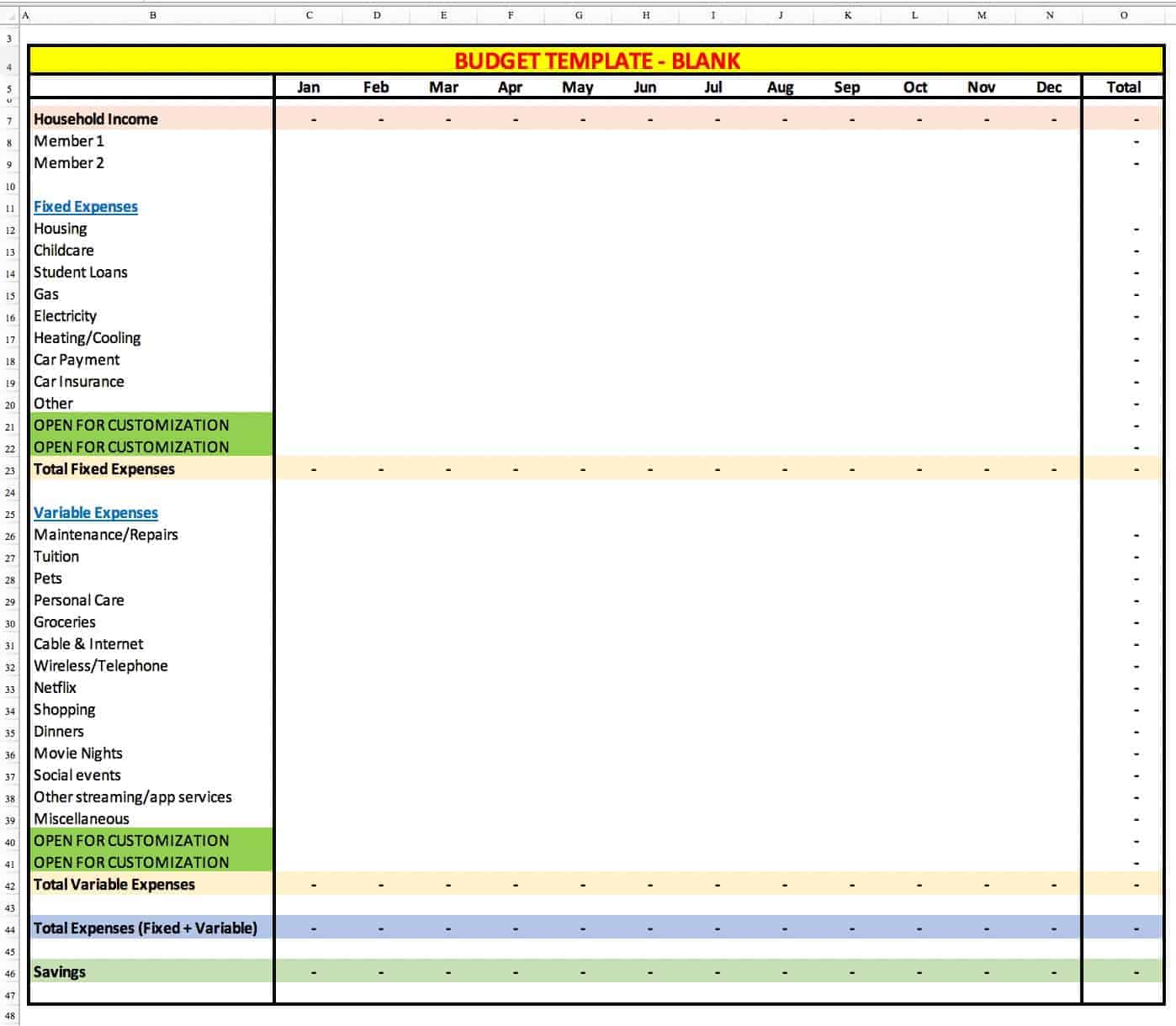

Also, you can use a budget template to breakdown your income and expense categories. This will help track your spending and identify any red flags that you need to adjust.

4) Create A Budget Template

A budget template is something that helps you track your spending and gives you a monthly snapshot of your income, expense, and savings. So, of all the budgeting tips, this will lay the foundation for your budget process.

Create a detailed template where you can identify all sources of your household income, list all monthly expenses, and ultimately determine your savings.

Here’s how you can approach this:

- Plan out your total household income. This should include every source of income (regular or irregular) you earn in a given month. Include the income from all jobs (if more than one), monthly investment income or dividends, income from side gigs, tuition, music lessons, bar-tending, etc.

- Next, plan your fixed expenses. These are the necessities of life that you cannot live without and includes expenses for Rental, Mortgage, Childcare, Student loans, Gas, Electricity, Auto loans, and insurance, etc.

- Next, its time to plan those expenses that are not necessities. In other words, you can manage to either live without them or reduce your spending if need be.

A simple template like the one below should be good enough to put your numbers together.

5) Get Granular With The Details

One of the most common reasons, why budgets fail is that they were never set up to succeed in the first place.

Imagine you are trying to reach a destination by road and all that your GPS/google maps show is the route, the distance and the time it takes.

Would that be helpful?

Not really. Details like the other route options, fastest route, gas stations, rest areas, toll road, etc. are important in your journey.

Similarly, if you can categorize your income and expenses into smaller sub-categories like in the template above, you are setting up your budget process to help you in your journey toward financial freedom.

6) Track Every Dollar You Spend

If you want to avoid the debt trap you need to know your numbers (finances). Also, you need to be prudent about how much are you spending and where are you spending your money.

Countless folks I know, either do not have a budget or are not tracking their monthly spending. The easiest way to end up in a debt trap with no savings is to not track your daily spending.

I know what you must be thinking – track every purchase I make?

YES!

And there are countless tools/apps available to make your life easy.

Personally, I have tried recording the daily expenses in tables that I drew on notepads, using excel spreadsheets, the “notes” app on the phone, to using budgeting apps like Mint and good budget.

But a couple of years ago, I came across an app called the “Spending Tracker.” It has 4.5+ stars and over 4,400+ reviews.

I gave it a shot and just fell in love with the user interface and simplicity of using the app. It is super intuitive and you will be an expert user in no time.

Download the app on iTunes here (not an affiliate link).

Download the app on Amazon here for Android (not an affiliate link)

Related Article: How To Save Money

7) Plan For Surprises

Another budgeting tip is to make sure you plan for surprises. In other words, you can anticipate most of the expenses you’ll have but not all.

There are always instances when you’ll have a couple of unexpected expenses knocking at your door.

Allocate a small amount every month for these surprises so you are not scrambling to find money when the expense actually hits. The goal of budgeting is to ensure you save money every month so make sure you do not let those surprises spoil the party!

8) Track Your Performance

This budgeting tip is going to make your budget robust every month.

Compare your actual spend vs. what you budgeted and identify the categories and sub-categories that you either overspent or underspent.

Why?

So you can make the necessary adjustments to your expenses and be in line with your spending expectations moving forward.

Also, every month is different from an expense standpoint. For example, you do not need to budget summer camp expenses during winter months. So, keep in mind that your expenses will vary every month.

9) Do Not Compare

One of the common reasons why budgeting does not work is that people start comparing their situation and finances to others.

This will certainly deflate any momentum you would have gained so avoid comparing to others at all costs.

You see, everyone’s financial situation is unique in their ways so what might work for you might not for them and vice versa.

So, this budgeting tip is very important from your mindset standpoint.

10) Budget Consistently With A Long-Term Focus

Another mindset related budgeting tip is to budget consistently.

If you push yourself to track expenses daily, it will become a habit after 66 days. Being consistent with anything for that matter will yield results – may it be studies, sports, business, gym or any area of life.

Another key budgeting tip is to have a long term focus. If you are pre-determined to just test it for a few days, it’s not going to help you. Having a long term focus gives you and your budget enough time to make the necessary adjustments and bring your spending in control.

Similar to the fact that it would be almost impossible to lose 100 pounds in 5-10 days, your budget is also going to need some time.

The best way to learn is by making mistakes (which you will initially) with your budget expenses, so don’t beat yourself up and be patient.

Summary

The budgeting tips we’ve discussed are extremely helpful to get you started with your budgeting process. If you’ve been struggling to budget before, follow these budgeting tips as they will lay a strong foundation for you.

I’d recommend taking one step at a time. I’ve tried to call out the steps in order so you can literally start from the first budgeting tip and follow the order.

Budgets are tools that will get you closer to your financial freedom instead of taking your freedom away (as many believe). All you need is the discipline to budget monthly and the patience!

Do you use any other budgeting tips? Please share your experience, thoughts, tips, and ask away any questions in the comment section below!

[convertkit form=908339]

This is a really informative post. The best take away for me is planning for surprises – that’s the one that always ruins my budget!

Thanks Katie!

Yeah, that budget thing. I have tried it in the past but given up too soon. I might just give it another try. Thanks for the inspiration and the practical tips!

Karen | https://OurCarpeDiem.com

Thanks Karen – definitely give it a shot and keep it simple. Focus on creating a budget template like the one shared and track your daily expense. You don’t need anything fancy and as long as you know how much are you spending vs. earning, that is half the battle won. You got this!

These are great tips for starting a budget and #1 is the most important! If you don’t know why you’re budgeting, it’s almost impossible to stick to the plan!

Thanks Rebecca and I agree!

Great post. I found the tips very useful especially the 50/30/20 idea.

Thanks Kyra!

Ugh I totally have to get it together with our budget in 2020. These tips will help!

Thanks Megan! Yes it will certainly help.

I use the envelope method for 5 month now and honestly I saved more than what I expected.

That’s great Amira!

Great advice, especially pointing out the importance of tracking every dollar. I have seen too many people claim to be on top of their blogging while choosing the ‘its just a couple dollars’ mindset, but that couple dollars each time can add up!

Thanks Britt

This is super informative. Thank you for sharing these great budget tips!

Thanks Kinzy!

I’m trying to get into the zero-based budget right now so I can quickly finish my loans. Its under 10K but I still don’t like having git. It feels so much like a burden.

Take it one step at a time Darceline! Create an action plan by week/month and break down the 10k into smaller goals by week/month. It will be much easier to pay it off that way. Thanks!

these are some amazing tips especially in quarantine when most of us have lost our jobs.

We’ve been married for 32 years and found that keeping a written list of short, medium, and long-term goals is quite beneficial when budgeting. Then, we track our progress toward these goals. The other thing I would add is that a mid-year budget check-up is also important. That July “budget date” has allowed us to spend a little more time than we generally do looking at the numbers and making adjustments to the plan for the remaining six months of the year.

That’s awesome Hope! Thanks for sharing!

Awesome tips especially for beginners or those that have no experience on budgeting!

Thanks Chris!

great tips!! thank you!

Thanks Sophia!

Very good post on the steps it takes to do a successful budget! I think this will be helpful to so many people.

Thanks DeShena!

Yes! Such a great article. Budgeting is so important. I really liked these tips and will be adding a few to my budgeting plan.

Thanks Alyssa!

Helpful tips. Tracking every dollar you spend is so important and eye opening. I couldn’t believe how much little purchases add up like a daily coffee & muffin and automatic monthly subscriptions.

Thanks for sharing Donna!

Great tips! I do the zero based budget and it works well for me! I’ve tried apps but haven’t really kept up with them so I’m going to try the one you suggested. Thank you!

Thanks Alycia!

Thanks, I wasn’t aware of the categories of 50/30/20 and others. I think I need to do the zero balance one but I always feel it takes too long. I will have to try out one of the apps.

Absolutely Lydia! The best way to understand what works for you is to try out the options. Thanks!

This was such a great read! I have never heard of any of the budget methods mentioned except for the 50/30/20 method. I would be curious to find out how the envelope method would work for me as I barely carry around cash with me and mostly only use debit cards. I might have to try that just to see. Thanks for sharing xxx

Glad you found it helpful Josie!

Loved this! People often don’t realize how important a good budget really is. Such great tips and a good reminder to stay on track.

Thanks Lyssa!

another fantastic post!

I love the way you compressed this topic into 10 steps, even though it is a large ocean.

particularly like the why you budget section.

helpful resource for beginners.

thanks for sharing this awesome post.

Thanks Hari for the kind words!

Hi Sam! This is a really great post! I really appreciated you mentioning the different types of budgets that you can create!

Glad you liked it Grace!

Great post I loved it and with new years around the corner these tips will come in handy for 2021.

Thanks Dawn!

this post is timely for my situation.

I got a full time job recently and I was looking for quality budgeting advice.

thanks for sharing this helpful post.

Thanks Hari!

Fantastic tips and post, some really great tips.

Thanks Bailey! Glad you found it helpful!

Thanks for sharing these tips! Budgeting can seem so overwhelming, but your post really breaks it down. I appreciate the addition of not comparing yourself to others. It can make budgeting more difficult!

Thanks Maggie!

Thank you for writing this post! I was actually shocked when I started to track every dollar that I’m spending.

For example, I was thinking that I’m spending $20 per month on “X”, but after I start to track my expenses, I just found that I actually spend more than $100 on that.

Absolutely Alex! It’s a pretty powerful tracking method to have at your disposal.

I completely agree that comparing your financial journey to other journeys is terrible! I’m guilty of that on a daily basis.

Thanks Melissa!

Great tips! I study, so I have to live on a budget. That’s why I will try to use your advice to be not broke at the end of each month 😀

Thanks Saskia! Agreed that it’s important to stick to your budget!