This article may contain affiliate links. I might earn a small commission if you make any purchases through my links and it comes at NO cost to you. For more information, please read my Disclaimer page.

Credit cards are like a double-edged sword. If you use your credit card wisely, it can really work in your favor! But, unfortunately, a lot of people end up with credit card debt that they have difficulty paying off.

This leads to you feeling frustrated, helpless and lost. Trust me, I get it!

According to a Federal Reserve article in September 2019, consumer credit card debt (also called revolving credit) surpassed $1 trillion which is both outrageous and alarming.

No matter the circumstance, you need to pay off your credit card at all costs. This is one of the important steps you are going to take toward your financial freedom.

So, instead of being the victim of debt, buckle up and address the devil head-on. What do you have to lose anyway?

There are ways to pay off your credit card and let me tell you, it’s not going to happen overnight. But, if you are disciplined and determined to be debt-free, YOU WILL BE!

So, let’s look at the options or ways in which you can pay off your debt fast.

1) Create An Action Plan

An action plan is a plan with steps you’ll be taking to achieve your goal(s).

You must create an action plan on how are you going to tackle your debt. I highly recommend not to wing it and make haphazard payments.

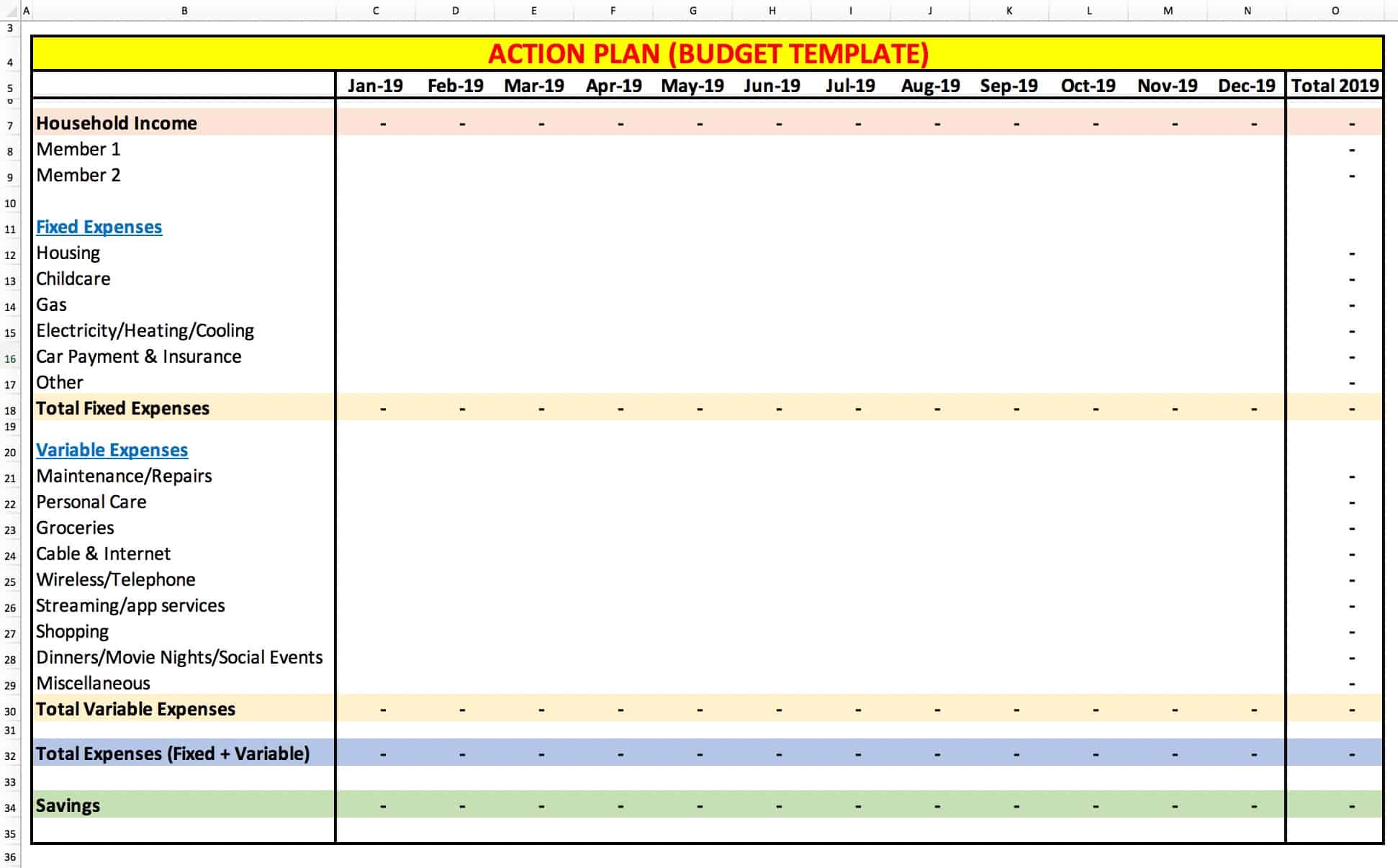

Create a detailed plan where you can identify all sources of your household income, list all monthly expenses, and ultimately determine your savings.

Here’s how you can approach this:

- Chalk out your income, expenses, and savings every month.

- Next, you want to layer in your debt from each account (student loans, credit cards, etc.)

- Determine if the amount you are saving is enough to cover the monthly debt payments.

- If yes, that’s great! If not, you’ll have to find innovative ways to either reduce your expenses or increase your sources of income.

A simple template like the one below should be good enough to put your numbers together.

Remember, the goal here is to determine how much you save every month.

Download FREE Budget Checklist

>> 50+ List of Budget Items

>> Budget Items categorized into 3 sections: Income, Fixed Expenses, Variable Expenses

2) Allocate The Amount You Can Contribute Toward Your Credit Card Debt

Once you know how much are you saving each month, allocate the savings to each form of debt you need to pay off.

Why is this important?

Because your monthly payment toward your student loans or another form of debt is not going to wait until you pay off your credit card.

So, it is imperative you determine the true amount you can put toward your credit card debt.

For example, if you are able to save $1,000 every month and once you pay off $500 toward other debt, the actual money you have to pay off your credit card debt is only $500 ($1,000 minus $500)

Often times, people do not allocate the correct amount and hence their budgets never work for them.

Being realistic about your personal finances, debt payoffs and savings is crucial if you are trying to be debt-free.

3) Stop Using Credit Cards

Yes! It seems like a no-brainer but so many people continue to use credit cards while trying to pay off credit card debt.

One of the biggest reasons why this happens is that folks live beyond their means.

The fact that you get 30 extra days to pay off the money you borrowed from the credit card company is so enticing and addictive that people forget it’s a trap (if they can’t pay)

The interest rates on those purchases after 30 days is astronomical (20% or higher on average)

So, why would anyone shoot themselves in the foot by using high-interest credit cards?

If you have trouble staying away from using your credit cards, cut them up and trash them. This action will eradicate the problem and you will have no other choice but to use cash.

A lot of people use cash as a go-to option for their everyday expenses. Some of my close family friends use cash and it works for them.

The idea is every week, you go to the bank/atm and withdraw a set amount of money. You use this for groceries, lunches, gas and other daily expenses.

The option to use cash prevents you from making unwanted purchases through your credit card. There are so many stories where people were able to cut down their expenses, save money and even pay off their debt by simply using this option.

There is certainly no harm in trying out this option if you haven’t already. If it helps to stay away from using credit cards, then you are in business.

Related Article: How To Use Credit Card Wisely

4) Save More To Pay Off Credit Card Debt

After going through your action plan and allocating money toward your credit card debt, if you determine the money will not suffice, obviously you’ll have to save more.

So, what are the options to save money?

- You can either earn more income every month AND(OR)

- Reduce your variable expenses

For additional income sources, you can take up a weekend gig, provide your services in the form of music or art lessons, drive Uber, deliver pizza and(or) groceries, delivery packages for amazon or other retailers and more.

Also, you can work overtime at your workplace (if that is an option) or offer freelance services from writing to creating an infographic for a customer. Fiverr is one of the most popular freelance service providers so I encourage you to check it out.

To reduce your expenses, try to adjust your spending in the variable expenses section first. If you can eat-in one weekend or reschedule a movie night or shop less, it goes a long way in saving more.

You see my approach here?

No matter what, I want you to push yourself to save at the end of the month. This will help you pay off your credit card debt faster and get one step closer to achieving your financial independence.

5) Choose A Debt Re-Payment Strategy (Debt Avalanche OR Debt Snowball)

Selecting the right debt re-payment strategy for yourself is one of those decisions that is mission-critical to the end goal.

There are a few strategies that can help you pay off credit card debt but we will discuss 2 popular strategies: Debt Avalanche and Debt Snowball

You can use either strategy as long as you stick with the one you’ve chosen until you pay off your debt.

Don’t switch between the two strategies as it will jeopardize your monthly budget numbers and the allocations. Also, you will have to redo your budget numbers along with the allocations if you switch, so avoid changing strategies as much as possible.

Debt Avalanche Strategy

If you are one of those people that hate paying more interest on your purchases, then this strategy is a good fit for you.

In this method, you will focus on paying off debt accounts with higher interest rates first, before getting to the debt with lower interest rates.

At the same time, you continue to make minimum payments on the other credit card accounts.

Once the account with the highest interest rate is paid off, you reallocate that money to the next highest account and so on and so forth.

- Pros of this strategy: Over time you will be paying less in interest payments once all the accounts are paid off

- Cons of this strategy: It takes a while before you see any concrete changes to your credit card accounts – but if you care more about not paying more in interest payments, this should not matter.

Debt Snowball Strategy

If you like to gain early momentum and would like to see faster results of your actions, this might be your strategy.

In this method, you will focus on paying off debt accounts with lower interest rates first, before getting to the debt with higher interest rates.

At the same time, you continue to make minimum payments on the other credit card accounts.

What this approach does is you will knock out smaller credit card debt accounts faster, gain momentum that will help you get to the finish line.

Once the account with the lowest interest rate is paid off, you reallocate that money to the next lower account and so on and so forth.

- Pros of this strategy: If you have small credit card debt accounts, this method is helpful. You can pay off small debt accounts faster and gain momentum.

- Cons of this strategy: The biggest downside is that over time, you end up paying more in interest payments as compared to the avalanche strategy. If you have a mountain of credit card debt, this strategy might not be a good fit.

So, between the 2 strategies, debt avalanche is more effective as it saves you money in the long run.

No matter what strategy you use, make sure it is the one that works with your finances. If you’d like, you can learn more about the debt avalanche and snowball strategies on Investopedia.

6) Reduce Your Interest Rate

Another common option available to you as a consumer is to reduce the interest rate on your debt. But the credit card companies won’t just reduce your interest rates because you are a customer.

You see, it has to be a win-win situation for them to agree for a lower interest rate. They are in the business of lending money and earning interest on balances not paid after 30 days.

So, here are a few things you could do to put yourself in the driver’s seat to negotiate:

- Do your homework by knowing your outstanding balance, your current rate of interest, your credit limit and how long have you been a customer

- Keep their competitor’s information and credit card offers handy. This is one of the trump cards you can play when the time is right

- Let’s say, for example, your debt on one of the credit cards is $5,000 and soon you’ll be paying an interest rate in excess of 20% on that balance. If possible, it might be a good idea to pay down that balance a bit before negotiating

- Once the credit card company gets the assurance that you are not a flight risk, they start working with you

- Be persistent and keep negotiating as much as possible

7) Debt Consolidation Method

Look, paying off credit card debt is a herculean task. And, oftentimes it takes a while before you can actually see your actions reaping results.

Debt consolidation is simply consolidating multiple credit card accounts into one account with low- interest payment every month.

Debt consolidation method works when:

- You have been regular monthly payments toward your credit card

- Your credit score is good

- You have enough money to cover the monthly payments on your cards

- There is a higher probability of you qualifying for a lower interest rate because of your credit score

On the flip side, there are fees associated with debt consolidation. One of the ways they offer lower monthly payments is by increasing the span of your debt repayment. This might not necessarily help you as you will end up paying more interest over time.

And, if you do not change your spending habits and personal lifestyle to run a tight financial ship until you are debt-free, this option is not going to help you.

Frequently Asked Questions (FAQs)

How do I pay off credit card debt with no money?

The short answer is that you need to find money to pay off debt. If you want to avoid bankruptcy, you have no other option but to pay off your debt.

You have 2 options:

- Earn more income AND(OR)

- Reduce your expenses

The first place to focus on is your variable expenses which include expenses related to food, shopping, social event, gym membership, vacations, etc.

If you can find more money by cutting down some of your luxuries or non-essential expenses, it makes a huge difference. Another alternative is to earn a side income and this could be anything from driving for Uber or delivering pizza/groceries to investing in stocks.

The bottom line is, there are a lot of ways to bring in money and you just need to figure out the best option for you.

Should I get a personal loan to pay off my credit card debt?

I’ll be honest with you – when I first saw this question pop up on google, I was actually shocked.

How can you borrow money to pay off the money that you borrowed?

You don’t need to borrow more money in order to deal with your debt. Instead, you need to get your act together and figure out a way to either earn more money, drastically reduce your expenses and save more.

Once you form this habit of consistently saving money, you will not need to take out a personal loan.

Should I get a home equity loan to pay off my credit card debt?

Again – absolutely NOT!

Do not put your home and your family in jeopardy by getting a home equity loan to pay off your credit card debt. Your home is the safest place on earth for you and your family to live so avoid squeezing out the equity no matter how sweet the offer is.

When the times are tough and you are not able to make monthly loan payments, they will come after your home. So don’t do it!

How do I pay off large credit card debt and should I use a Balance Transfer card?

If you have significant credit card debt, you need to focus on paying off debt with the highest interest rates first (also called debt avalanche strategy).

This ensures that you are going to pay less interest over time.

Another option is to transfer all your debt to a 0% APR balance card. These are cards that offer you a 0% interest rate on your balances for a specific time period.

Balance transfer cards help you pay off your credit card debt faster as more and more payments are made toward your principal balance. Also, you can consolidate multiple accounts into one account which can simplify your payment structure every month.

Should I use the Debt Settlement option to pay off my credit card debt?

One of the other options available to you to pay off your credit card debt is the debt settlement method. It is also called the debt arbitration method.

With this method, you can settle your debt with the credit card companies for a lower amount than what you owe. There are stories of people actually settling for 60% less than what they owed.

Sweet deal right?

However, to reach a settlement with the credit companies usually takes a long time. Also, if they determine that you will be able to pay off the full balance, they won’t offer any settlement. It also takes a lot of time, effort and fees throughout the process and this can add fuel to fire with your financial situation.

And needless to say, by this time your credit score is completely shredded as you’ve had collection calls and late payment penalties.

So, other alternatives where you can find better help is either a Chapter 7 bankruptcy or Chapter 13 debt payment plan.

Summary

If you are serious about achieving financial independence, being debt-free is non-negotiable. So, take the necessary steps toward your financial freedom by paying off your credit card debt.

Your credit card debt impacts your credit score which further impacts the interest rates on your future purchases. So at the end of the day, you will end up paying more and more in the long run.

Focus on creating an action plan (budget) as mentioned at the beginning of the article. This will provide you with a blueprint to work with. If you are disciplined and determined to pay off your credit card debt, trust me you will get to the finish line.

Also, the debt repayment strategy you choose (debt avalanche or debt snowball) is crucial. No matter which one you choose, you need to make sure it works with your finances and your long term financial goals.

[convertkit form=908339]

How do you plan to pay off your credit card debt? Please share your experience, thoughts, tips, and ask away any questions in the comment section below!

An excellent guide to paying off credit card debt! I’ve paid off probably $40,000 to $50,000 in credit card debt and have $0 now. What worked for me the most was using the debt snowball and increasing my income. It was a lot easier to make a dent in the balance when I had more money coming in to throw at it.

Thanks, Rebecca and great to hear that you now have no credit card debt!

I’m so glad you talked about reducing your interest rate! All it takes is maybe 20 minutes on the phone and could save you decent money! Do this will all your credit cards and loans and it adds up fast to a good chunk of change!

Thanks Kari! The savings from the reduced interest rate goes a long way.

If you can control the use of credit card, you have won 40% of the battle. Every other thing follows effortlessly. Great tips and well laid post.

Thanks Nadia!

These are all great tips for paying off debt. I use the snowball plan cause it shows me that I can do it when I pay one bill off.

Thanks Kathy!

Great tips! I love our credit card when we’re racking up the rewards…the only thing is that you have to use the credit card to earn the rewards. Sneaky, sneaky! 🙂

Yup if used wisely, it really helps. Thanks!

No credit card debt here! Woo hoo!

That’s awesome Vanessa!

This is such a helpful and detailed post! Thank you for sharing all these great tips and ways to pay off your credit card debt xx

Thanks Valentina! Glad you found it helpful!

I paid off my credit cards using the debt snowball method and every time I paid off another card I would add that payment to the next. Great tips and the importance of paying that debt off

Thanks Kathy! Glad to hear you paid off your debt.

I have completely eliminated credit card and car note debt. Working on paying off the house. My husband has also paid off credit card debt, car note debt and student loans. We lived off one income for 6 months to pay off his student loans. Thanks for sharing.

Thanks Sabrina for sharing! Congratulations on paying off your debt!

Debt consolidation on a card with a lower interest rate (or a new card at an introductory 0% interest rate) is a game-changer. I have a family friend who kept finding new card offers with free balance transfers every time her 0% introductory rate with the previous card expired to the point where she had 0% interest for YEARS until she paid it all off! Thanks for your tips!

Thanks for sharing Annie!

Such good tips for anyone who has any debt. Information everyone should know!

Thanks Jessica

Great article and thanks for the info. Even though I’ve read about some of these options before, your explanations and examples made it more relatable to me. I didn’t even know calling to get a lower interest rate was an option.

Glad you found it helpful George!

#1 should be CUT UP THE CREDIT CARDS to remove temptation. Credit kept me prisoner for many years but I am now debt free (using many of the tips you describe). The result of not being beholden to a credit card company is utterly indescribable freedom in life to live how I choose. Never again will I be a prisoner of financial debt. Lesson learned.

Absolutely agree Christina! Racking up credit debt is the #1 hurdle in the financial independence journey. Thanks for sharing!

This came into my life at the best time! I am looking into learning how to get on top of my credit card debt. This really helps. Thank you.

That’s great Bailey! Hope you found it helpful!

Great tips! We have paid over $35K of credit card debt using the debt snowball method! ????

That’s amazing Charity! Thanks for sharing!

I actually have a gig on Fiverr where I share a simple debt snowball spreadsheet and it’s so interesting to see how much difference a snowball or an avalanche strategy can make over the life of a loan. People get frustrated because it takes months or even years to get out of debt, but it took a long time to get into it, so of course it’s going to take time to get out. That’s why I started as a Fiverr seller – to get myself out of debt and I paid off my last bit of debt just two months ago.

That is awesome Adrian! Thanks for sharing!