This article may contain affiliate links. I might earn a small commission if you make any purchases through my links and it comes at NO cost to you. For more information, please read my Disclaimer page.

As the name suggests, a zero-based budget is a budget that starts with a “zero-base”. In other words, you have to account for every single dollar amount of your household income.

Mathematically, your Income (minus) Expenses should (equal) ZERO for this budget method.

So, if your household income per month is $7,000, you need to create a budget where you are going to allocate $7,000 across expenses, debt payments, investments, and savings.

Now, let’s take a look at how to create a zero-based budget in Microsoft Excel. You can use this methodology with any tool like Numbers (for Mac), budgeting apps or traditional pen and paper.

How To Create A Zero-Based Budget

Step 1: Plan Your Household Income

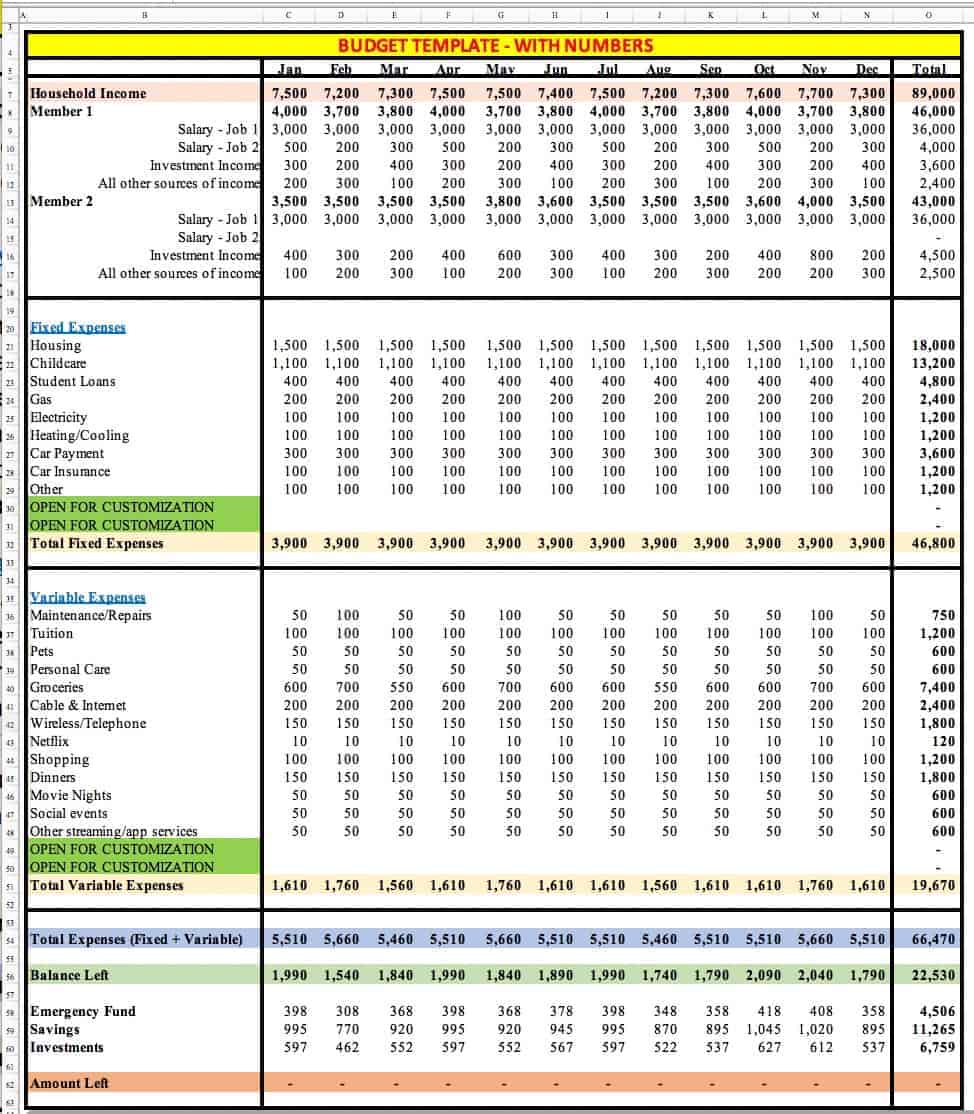

The first step in creating a zero-based budget is to plan your household income. This should include every source of income (regular or irregular) you earn in a given month.

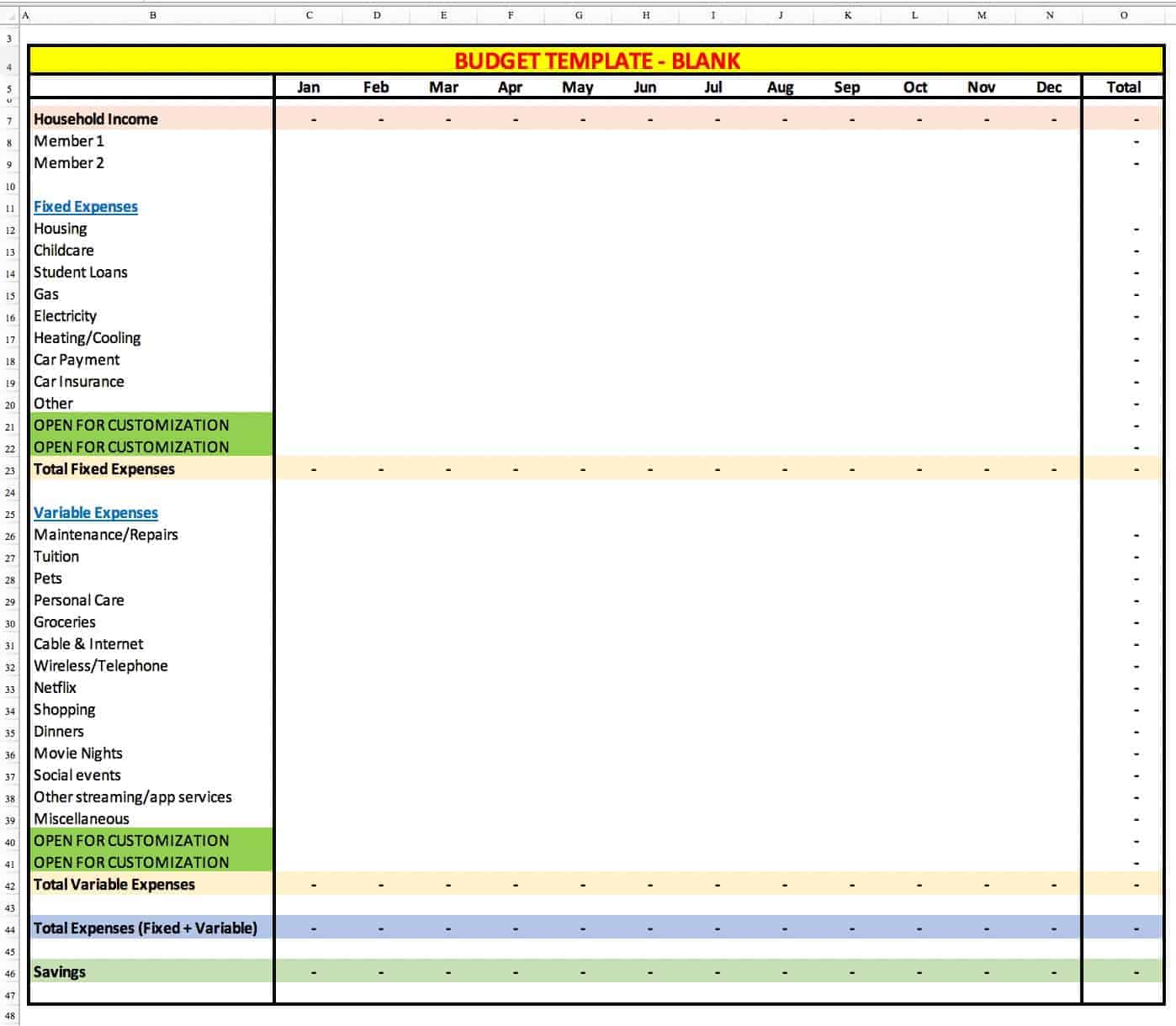

Create a blank budget template that is similar to the below format.

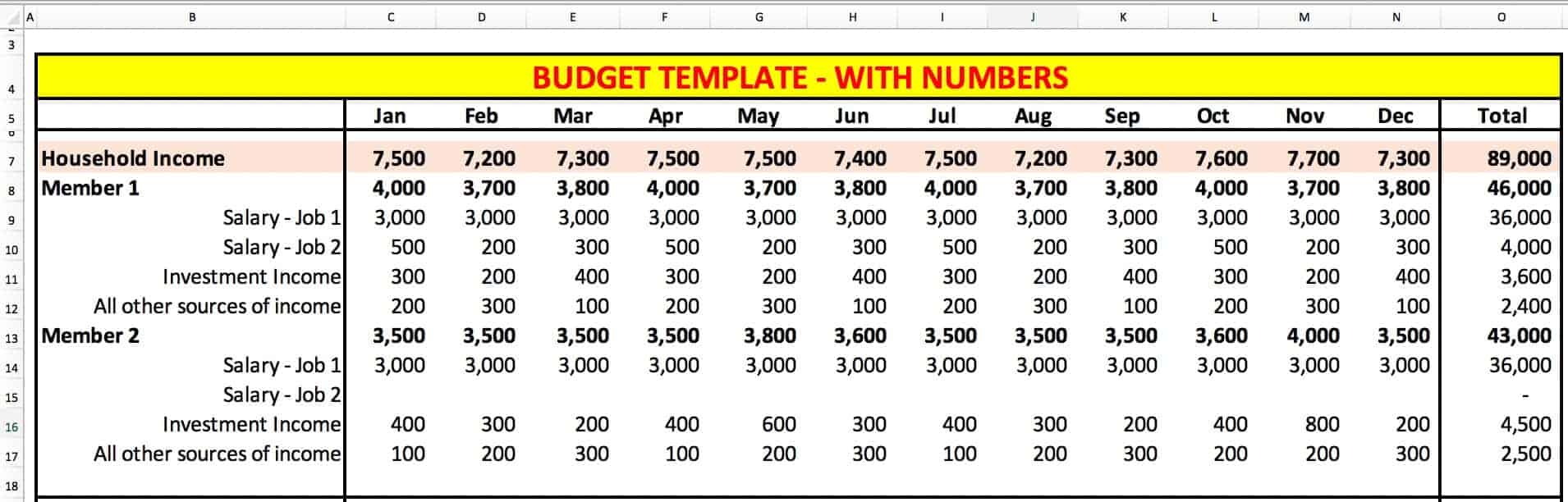

Now, include the income from all jobs (if more than one), monthly investment income or dividends, income from side gigs, tuitions, music lessons, bar-tending, etc.

The goal here is to account for all sources of income so you can allocate/assign them in the expenses section.

Now, your household income can be different every month as not all sources of income are regular. Also, make sure you are breaking down the income sources by members. This gives detailed visibility of your income sources.

Once you’ve figured out the split by members, populate the table. It might look like the one below, for example:

Step 2: Plan Your Fixed Expenses

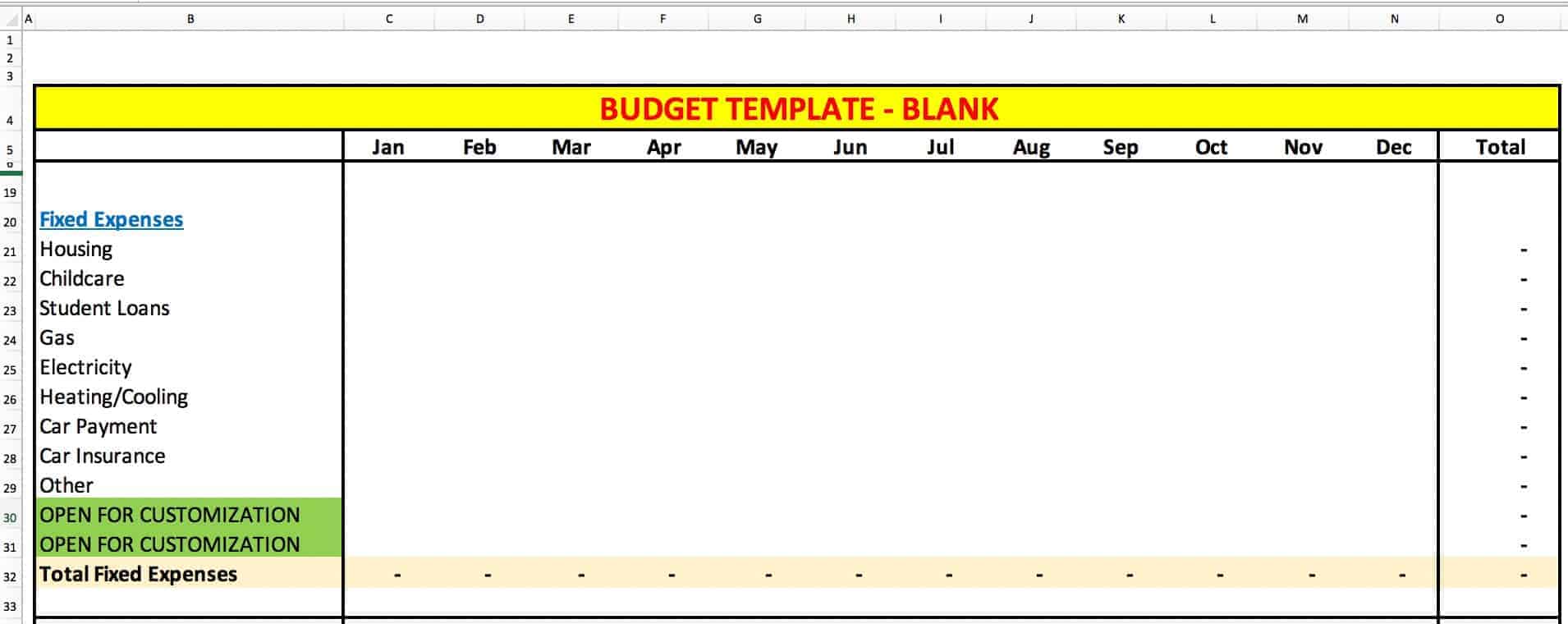

In this section of the zero-based budget, you are going to plan the expenses that you need in order to live your life.

These are the necessities of life that you cannot live without and includes expenses for Rental, Mortgage, Childcare, Student loans, Gas, Electricity, Auto loans, and insurance, etc.

Also, keep a couple of options (green highlights in the picture above) open for any new expenses that you may need to include.

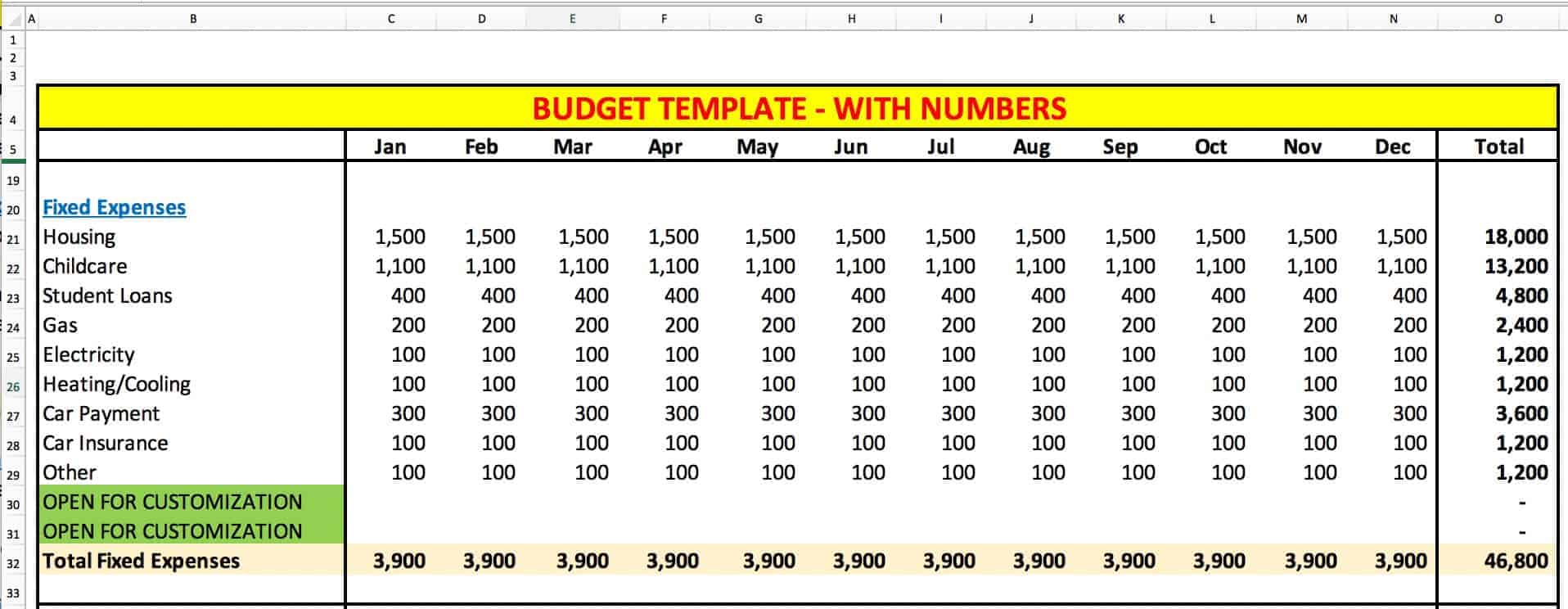

Once you’ve accounted for all the categories within the fixed expenses section, populate the numbers.

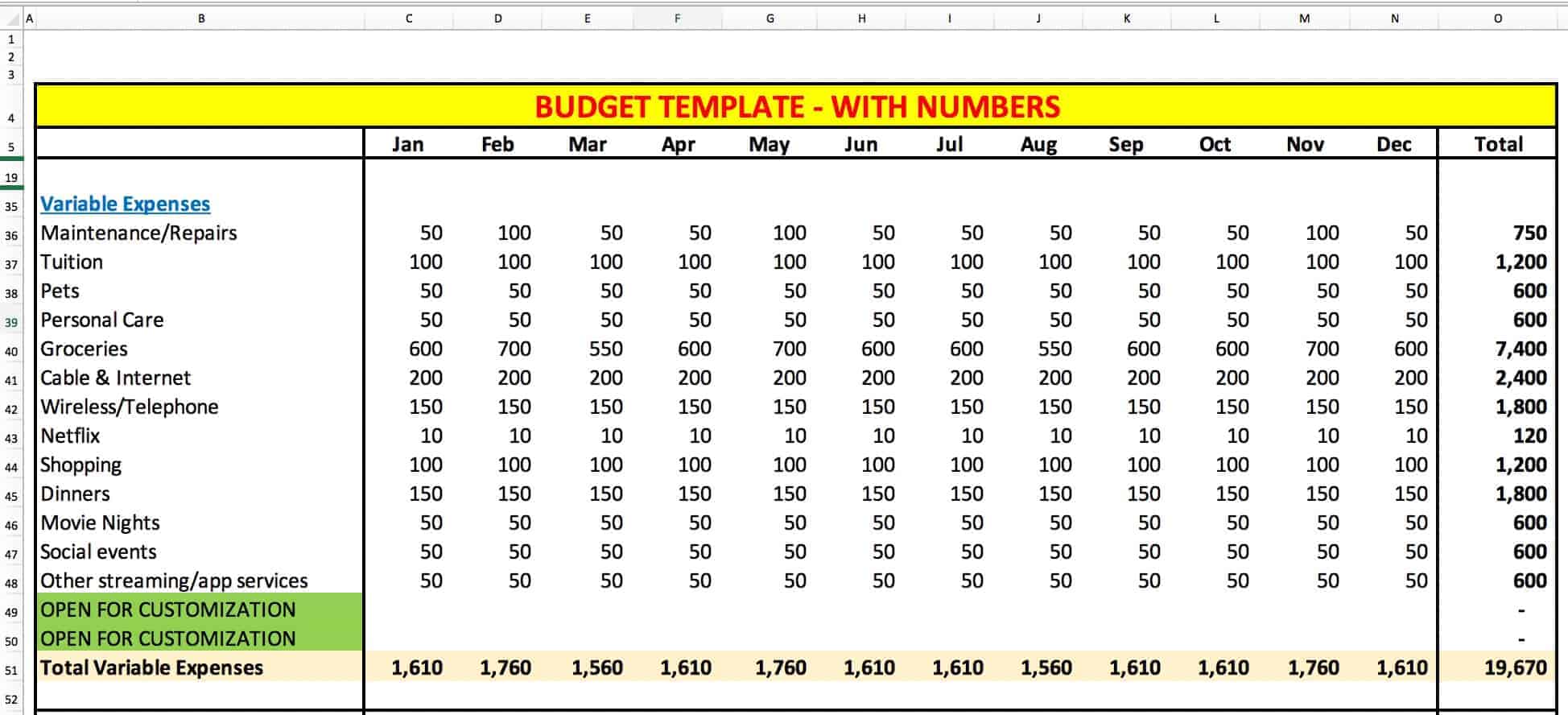

Step 3: Plan Your Variable Expenses

Now, its time to plan those expenses that are not necessities. In other words, you can manage to either live without them or reduce your spend if need be.

When you make a budget, always differentiate between the expenses that you “need” vs. “want”.

Why?

So that you know the expenses you can reduce and cut if you lost your job or if the economic times are tough.

Remember, try to breakdown your expenses as much as you can. This will allow you to precisely pinpoint the areas of improvement.

Now, you can populate the numbers within each month.

Step 4: Plan Your Savings and Investments

As part of the zero-based budget, allocate money to savings, emergency funds, investments and(or) other items you see fit.

This is critical in order to not lose sight of your spending and savings.

The goal of this step is to ensure that the difference between your Income and Expenses/Savings/Investments is “zero”. It will take some time and a few iterations of this zero-based budget process for you to get your allocations in place.

If you’re overspending in a month, you’ll have to look for options to trim down your budget. Try to reduce your expenses related to eating outside, social events, concerts, etc.

As you can see from the table above, the “Amount Left” in row 62 is “zero” which is the goal of a zero-based budget.

Why Is A Zero-Based Budget Important?

A budgeting process is important for a couple of reasons:

- It allows you to dive deeper into your personal finances and provides insights into your income and expenses.

- Tracking your money on a monthly basis pushes you to be more responsible and accountable with your money.

Zero-based budgeting offers both of the above benefits. It is a detailed process as it takes a few months and iterations to find the right balance of Income, spending, and savings.

If you feel like you do not have control over your spending, zero-based budgeting is the way to go.

Advantages Of A Zero-Based Budget

1. Relationship With Your Money

One of the biggest advantages of using a zero-based budget is that it will change your relationship with your money.

How?

You will be more focused on your money as you now have more insight into your income sources, expense categories, and savings and investments.

Also, you will start to see the progress toward your financial goals. If you are implementing the budget process on a monthly basis, you will eventually see results.

2. Increases Awareness With Your Money

By design, a zero-based budget will force you to dig deeper into your finances and plan your monthly categories (as seen in the tables above).

Once you’ve identified your categories, you will start to see your spending habits aligning with those expense categories. If you’re living paycheck to paycheck, pay close attention to this advantage.

The moment you know when your money is coming in, going out, where are underspending vs. overspending, you can plan your next month’s budget and make adjustments.

Now, you are aware of certain spending items you need to address and that will help you avoid future surprises.

3. Helps Pay Off Your Debt

Another advantage with a zero-based budget is that it will help you pay off your debt quicker.

How?

The more detailed your budget, the more aware of where are you spending and how much are you saving. Once you save, you can route that money to pay off your debt.

Related Article: To learn more about debt repayment, check out my article on how to pay off your debt.

4. Align Your Lifestyle With Your Financial Goals

If you want to achieve your financial goals (both short-term and long-term), you need to identify and understand your financial necessities.

You should be debt-free if you want to be financially independent.

So, if you have student loans and credit card debt, clear those debts first. Make the necessary adjustments in your life so you can save more and divert those savings toward paying off debt.

Once you start making small adjustments to align with your monthly budget, you indirectly align your finances with your long-term financial goals.

Related Article: To learn more about saving money, check out my article on

how to save money.

5. Track Your Money

Another significant advantage of a zero-based budget is that it pushes you to track your money.

You have to track your money on a daily basis and keep a tally of running totals to get to a monthly total. Now, you could either use digital apps or traditional paper & pen to track the flow of money,

The process of budgeting increases your financial literacy about your own money. And, it puts you in a position to make quick adjustments if you’re overspending or not saving as much.

Take Action

Now that you understand what is a zero-based budget, it’s time for you to take action. Remember, just reading this article without actually creating a budget and tracking expenses will not be helpful.

The first 2-3 months will be test and trial so, focus on understanding your income sources and spending habits.

Once you have a better understanding of your monthly finances, you can switch to the zero-based budget and start tracking.

On an ongoing basis, make adjustments in your lifestyle as you see fit. There is no right or wrong answer to budgeting but accounting for every dollar will give you the much-needed insight into your finances.

Try to have fun with the process rather than stress about it. It’s a process that takes a while to fully comprehend so do not beat yourself up.

The key to mastering the budget process is consistency and discipline to incorporate the process into your lifestyle.

Summary

Cultivating good habits is hard – especially when it comes to money! Think of budgets as a tool that will guide you toward your financial independence.

There is a notion that budgets are like handcuffs that do not allow you to live the life you want to. Truth be told, to have a budget that highlights the flow of your money and red flags any events that need attention is what you need if you are in debt and looking to save and invest money.

Managing a zero-based budget can be a little time consuming, but is absolutely worth it in the long run.

I’d encourage you to try out this method of budgeting by following the steps listed in this article. If it does not work, you can always switch to some other method.

Please share your experience, thoughts, tips, and ask away any questions in the comment section below!

Totally working towards this! Your post is such a great resource, I’m definitely bookmarking this!

XO Steph

Glad you found it helpful 🙂

My husband and I have been managing a zero based budget for the past year and it is incredible to see how much more we are able to save when we are more aware of where the money is going.

That’s awesome. It is a game changer!

Pingback: 20 Ways To Get Out Of Debt: How To Tackle Your Debt & Pay It Off Fast

I may have never called it zero based but I’ve been doing it. I don’t usually track investments as they came out organically. But a phenomenal setup for new budgeters. You are awesome Sam!

Thanks for those kind words John 🙂

I often saw “zero-based” budget everywhere but never fully understood what it meant. Now it makes so much sense! Thanks so much for this informative post 😀

Glad you liked it Corinne!

I love a zero based budget. I just started this in January

I’ve never heard this term before! But a zero-based budget makes sense! Thank you for the great breakdown and tips!

Glad you found it helpful Morgan!

Pingback: 10 Budgeting Tips: Build A Budget That Works For You

The zero-based budget is new to me but it’s truly rewarding in the long run! Thanks for all this valuable information and I will definitely share with my friends.

Thanks Hannah!

Great post. We should budget every dollar down to the penny. Thanks for sharing.

Thanks Sabrina!

Good pointers. I’ve honestly fallen off of the wagon lately, but I firmly believe in the zero based budget. It got us completely back on track.

We have recently started to keep an eye on our budget and spendings and it all makes so much sense now. Fab insights.

Thanks Sunrita!

Spot on list! Well put and summarised, Sam!

Thanks Isabel!