This article may contain affiliate links. I might earn a small commission if you make any purchases through my links and it comes at NO cost to you. For more information, please read my Disclaimer page.

Chances are, you are reading this article either because you are currently in debt and trying to figure a way out or you are debt-free and would like to keep these tips handy to avoid falling in the debt trap again.

Either way, it’s a win-win situation!

You see, dealing with debt (student loans, credit cards, auto loans, etc.), creating an action plan, trying to save daily, not being late on your monthly payments, sweating about interest penalties and more can be quiet daunting and overwhelming.

But, if you take a step back, put an action plan in place and execute your strategy, you can get out of debt sooner than you anticipate.

According to a 2018 NBC news article:

- Nearly 78% of millennials are in debt.

- Approximately 56% of millennials with a college degree have credit card debt

- 62% of millennials have more debt, overall, than personal savings

The reason we are in this situation is two-fold:

>> First, the traditional college degree costs way more today than what our parents/prior generations paid.

>> Second, the pay rate for both entry-level jobs and jobs with 2-3 years experience cannot match the rate of increase in tuition over the years

According to a CNBC article:

>> Students at a public four -year university in 2017-18 paid tuition that is 213% higher than the costs in 1987-88

>> A private non-profit four-year institution costs 129% more than what it costs in 1987-88

The numbers are absolutely startling!

So, it is imperative that you have an action plan and a strategy in place to tackle your debt.

Here are 20 ways you can get out of debt.

1) Create A Financial Plan

Your financial plan resembles the blueprint of your finances. If you want to get out of debt, you need to first understand your finances (income, expense, savings, investments, debts, etc.)

First, identify the total household income that you can work with. This should include income from all sources for all earning members (adults only)

Next, get insights into your spending habits that fuel your lifestyle. Then, determine the savings amount per month (Income (minus) Expense)

Finally, layer in your debt, investments you’d like to make, insurance requirements for you and your family, college education for kids, and any other personal requirements.

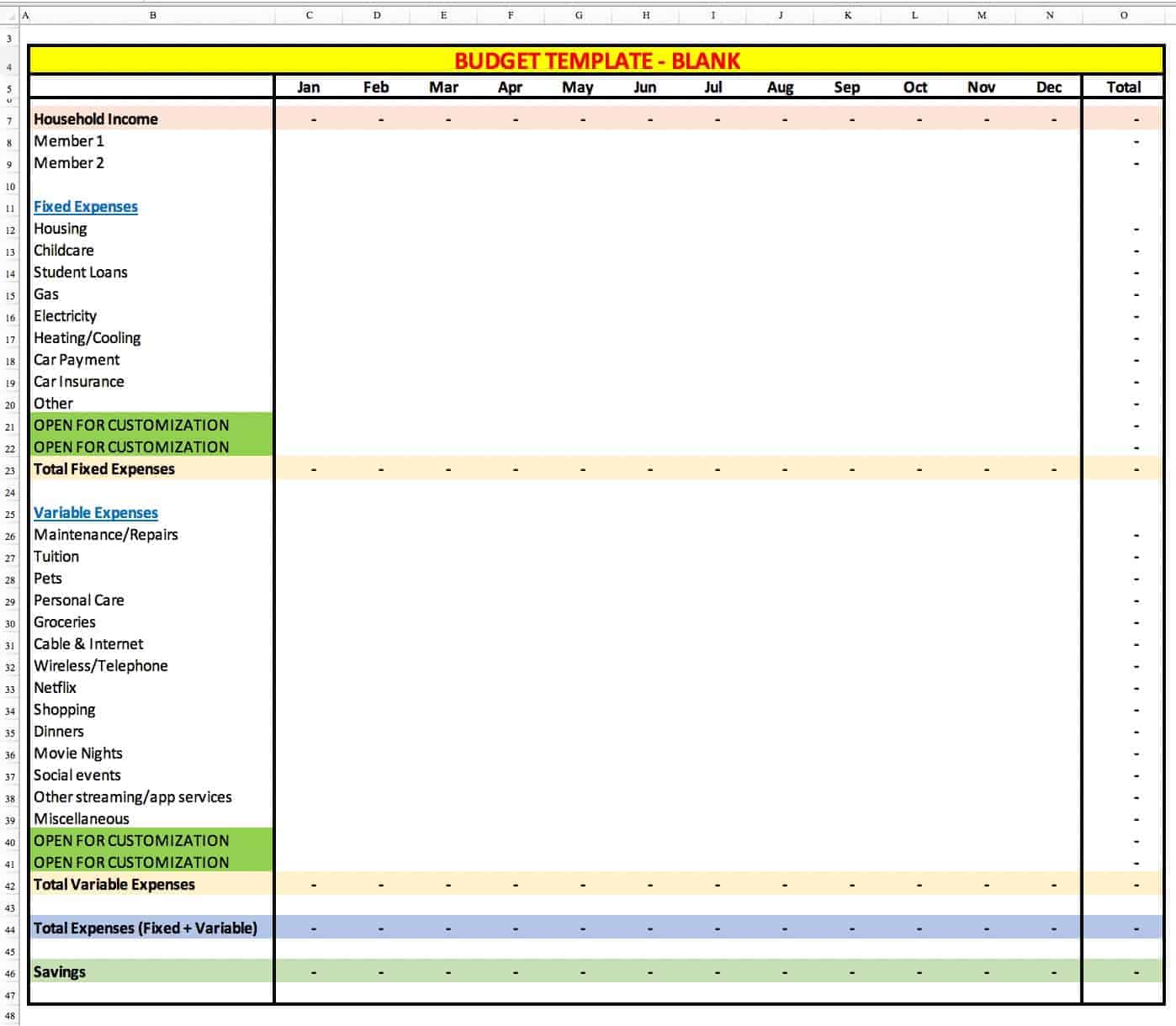

2) Create A Monthly Budget

Once you have your financial plan in place, it’s time to create a monthly budget.

Why?

Consider the budget as a mini financial plan that guides you with your finances every month. A budget can be a very handy tool if you want to get out of debt. Similar to how you can make your money work for you, you can make your budget work to save money.

The sole focus of your budget is to track your spending and savings against your monthly plan.

This will identify the problem areas and help you understand the lifestyle changes you need to make. If you are tracking better vs. the plan, get ahead and pay more toward your debt. A smart strategy to get out of debt would be to pay off your debt fast by paying little interest as possible.

You can create your budget using the below format. Keep it simple so the update process is quick and smooth.

To dive deeper into the process of updating the budget and the kind of budget method to use, please read the related article.

Related Article: What is a zero-based budget

3) Save First Mindset

Imagine this – Every month you save the amount you had planned for!

Wouldn’t that be amazing?

Well, you can actually achieve that goal. Here’s how.

For example, if your monthly salary is $4,000 and your savings goal is $1,000, the save first mindset asks you to simply transfer $1,000 from the monthly paycheck you receive. If you receive bi-weekly checks, you can split the $1,000 into two $500 chunks.

The idea is, before using your paycheck for expenses, you have already managed to save.

Now you have $3,000 ($4,000 minus $1,000) left to manage your monthly expenses. This trick has worked wonders for me as it encourages me to both save and spend less. I do struggle sometimes to manage my expenses but that is the challenge we need to overcome.

Give it a shot and see how you do. It takes a while to develop this habit but is absolutely worth it in my opinion!

4) Earmark Your Money

This is another trick that comes in real handy when you want to get out of debt.

When you receive your paycheck, earmark the dollars for each category based on the budget template above. This will highlight how much amount is available for each expense categories (fixed and variable)

So, right off the bat, you know the spending threshold for each category.

Earmarking also helps you to take a proactive approach and make necessary adjustments if your expenses run higher or if you are not saving enough.

5) Track Every Dollar Spend

If you want to be debt-free you need to know your numbers (finances). Also, you need to be prudent about how much are you spending and where are you spending your money.

Countless folks I know, either do not have a budget or are not tracking their monthly spend. The easiest way to end up in a debt trap with no savings is to not track your daily spend.

I know what you must be thinking – track every purchase I make?

YES!

And there are countless tools/apps available to make your life easy.

Personally, I have tried recording the daily expenses in tables that I drew on notepads, using excel spreadsheets, the “notes” app on the phone, to using budgeting apps like Mint and good budget.

App For Tracking Your Spend

But a couple of years ago, I came across an app called the “Spending Tracker.” It has 4.7 stars and over 4,400+ reviews.

I gave it a shot and just fell in love with the user interface and simplicity of using the app. It is super intuitive and you will be an expert user in no time.

Download the app on iTunes here (not an affiliate link).

Download the app on Amazon here for Android (not an affiliate link)

6) Invest & Grow Your Money

Yeah, I know. You must be thinking that I barely have money to save and pay off debt. How can I invest?

Depending on your situation, the answer will vary for this question. If you have a lot of debt, I’d suggest you revisit this option at a later time.

You can start with as little as $20 and keep adding to the fund. The idea is to invest in stocks (primarily value and income stocks) for steady returns. Avoid growth stocks at this stage as they are highly volatile and you don’t want to lose money.

The reason you target value and income stocks is that the investment risk is low and you can earn dividends and steady returns on your investment.

Depending on your situation and risk appetite, you would want to take advantage of the returns that stocks offer to grow your money so you can get out of debt.

7) Get A Weekend Job

If possible, work a weekend job (second job). If you are alone, there is no doubt in my mind that you can work on weekends and earn extra cash.

The additional cash will help pay off your debt faster.

You can either be a delivery person or an Uber or Lyft driver. If that’s not your thing, you can start a business on the side. There are multiple ways (legit) you can earn some cash over the weekend.

The point is to bring in additional cash to help you get out of debt and manage your monthly expenses and savings.

8) Start A Side Gig

You can earn extra money by either being a coach to a school sports team, offering music lessons, giving tuitions or even wearing your DJ hat over the weekend.

Also, you could start your own business if that is your thing.

Again, there are countless options to start a side gig, earn money, and help you get out of debt. As much as possible, find a way to make extra income. It goes a long way in making your life a bit easier.

9) Brown Bag Your Lunch

If you buy daily lunch from outside, on average, that is around $8/day, which is $40 per week and $2,080 per year.

See if you can brown-bag your lunch and save money. The savings from just brown-bagging your lunch could help you pay off your student loans faster or take care of the yearly auto expenses or help you invest in stocks.

The possibilities are endless on how you can use that extra cash and help yourself to get out of debt.

Similarly, reduce the number of times you have dinner outside in a week. You can save that extra $20 – $40 and put it toward your savings fund.

10) Say Adios To Starbucks, Dunkin And Your Local Coffee Shop

I can imagine a lot of faces turning red but please hear me out!

On average, it costs around $2 – $2.50 for a medium coffee. If you buy coffee from outside every day, that is approximately $14 – $17.5 per week, which is $728 – $910 per year.

Take a moment and revisit that number…

That is a lot of money you spend on outside coffee. To save money, reduce the number of times per week you buy coffee from outside. The best way to still enjoy the brand of coffee you like is to buy the ground coffee packs and brew it yourself at home.

It will save you a fortune and you can still enjoy your brew.

11) Shop Less

Do you know how much you spend on shopping every month and each year?

Chances are, a lot more than you actually need to. You see, shopping is for the most-part a feel-good activity where you go to the malls or local shops and enjoy checking out stuff.

Yes, I agree – it feels great to shop for new clothing apparel, shoes, jackets, accessories, etc.

But, not keeping track of your shopping spend can be quite detrimental to your effort to get out of debt.

Try to limit your shopping to once a quarter or ideally, twice a year.

12) Buy What You Need

If you want to be debt-free, you need to save more and in order for you to save more, you need to spend less.

Spend on stuff you need vs. what you want. Resist the urge and the feel-good feeling you’d get from shopping for things you do not need.

Make a shopping list of things you need so it’s much easier on your mind to focus on the shopping items that are essential.

13) Keep A Check On Your Subscriptions

With the digital age, we now have more subscriptions to apps and streaming services. In a futuristic world, it’s more likely that we see an upward trend.

So, now more than ever it is essential to revisit the streaming subscriptions on a semi-annual basis and at a minimum on an annual basis.

If you still have cable along with other streaming services like Netflix, Amazon Prime, Hulu, Apple TV, and others, you are paying a fortune.

In order to get out of debt, expenses toward subscriptions should be minimal.

14) Cut The Cord Or Downgrade

If you have a cable package with hundreds of channels, ask yourself, do you really need it?

Piggybacking on #13 regarding subscriptions, we are now in a different era of content viewership as compared to the last few decades. We consume content on the go and that means that cable is losing its importance.

If you want to get out of debt, this is one place you can look to either cut the expense or downgrade to a basic package and save more money.

15) Choose The Credit Card That Works For You

Choosing a credit card these days is like picking a cupcake out of a box of 20. There are simply so many options and you want them all 🙂

But hang on!

Make sure that the credit card you choose fits your financial needs and helps you in your journey to being debt-free

Cash-back credit cards are one of the best options if you want to get out of debt. With these cards, you get a set percentage (%) back for every purchase you make.

From the gas station to groceries and even for shopping, you can earn some money back for every dollar spent.

Related Article: How To Use Credit Card Wisely

16) Negotiate A Lower Interest Rate On Your Credit Card

As you know, credit card interest rates are outrageous (upward of 20% on average). And, there is a reason for that.

You see, the credit card companies are in the business of lending you money that allows you to make everyday purchases without cash.

For the most part (except a secured credit card), the first 30 days are interest-free. Meaning, if you pay your monthly balance in full, there will be no interest charged.

This assures the credit card companies that you are able to pay the balance and that they don’t have to worry about your financial solvency as long as you keep paying in full.

The moment you are not able to pay your balance in full and make a minimum payment, it’s a red flag. So, the credit card companies will charge you interest on the difference between the full balance and your minimum payment.

If you want to get out of debt, look for a credit card that offers a lower interest rate.

17) Ditch Your Most Expensive Habit

We all have one!

When you are trying to get out of debt, every dollar counts. If you are short on savings or struggle to manage your expenses, you might want to look into your habits and figure out an alternative.

If your expensive habit is to shop every weekend, you should stop that habit or if you have lunch outside every day, you might want to cut down on that.

Look for alternatives that are less expensive and can help you with your financial goals.

18) Use Coupons & Discounts

This is one of my personal favorites. Looking for coupons and discount codes helps you save more on your purchases.

Why pay more for something when you can pay less and get the same stuff?

Swagbucks, Rakuten, Retailmenot, Coupons.com are top sites where you can find great deals, coupon codes, and discounts.

19) Donate OR Sell What You Don’t Need

If you look around your basement, garage, or storage room, I’m sure you’ll be able to find stuff you don’t need. You can donate the stuff you do not need to thrift/goodwill stores. The store will provide a receipt with the equivalent $ amount.

And the BEST part? In some cases, your donations are tax-deductible. See IRS guideline here

OR

You can sell your stuff on eBay, Facebook Marketplace, or any other platform, or even organize a Garage sale.

The money you earn can go toward your savings fund to help you pay off your debt quicker, and that’s a great feeling!

20) Try The NO SPEND Tactic

Yes, you read that right!

One of the tactics you can apply to spend less is to go on a “NO Spend” holiday. This means that you only spend money on the essentials and nothing else.

See how long can you go without spending on the non-essentials. Every time, try to beat your previous record and in a few months, you will develop the habit of not spending on stuff you don’t need.

Summary

Look, I understand that it is both stressful and overwhelming to get out of debt. But at the same time, it is not difficult if you are aware of the process and can put an action plan in place.

When it comes to being debt-free, the ball is in your court. Countless folks have paid off huge amounts of debt so it is not impossible (I paid off close to $40,000 in student loans and debt in 3 years)

The reason I was able to get out of debt is that I had an action plan in place and diligently implemented that every month.

So, follow the 20 ways listed in this article and it will surely help you make progress toward being debt-free.

How did you manage to get out of debt? Please share your experience, thoughts, tips, and ask away any questions in the comment section below!

The statistics you shared here are alarming. I bet many people can find it as a good advice and turn their lives around for good.

Indeed Nadia. I was alarmed too. Thanks!

solid actionable tips I will be including some this month for me to move forward. Thank you.

Thanks Jiselle!

Awesome post!

Glad you liked it. Thanks!

Great tips!

Thanks Melissa!

This is a very comprehensive and helpful guide to get out debt. I’m sharing it so many other people in debt find it 🙂

Thanks Corinne!

Very informational article! Its hard enough to get out of debt, but just as difficult to budget money properly in order to stay out of debt. Thanks for sharing!

Thanks Eric!

Tracking money and spends

And starting investment at right time are really helpful for any person to overcome debts

Absolutely!

I love blog posts about different ways to get out of debt and get your finances together. Great read!

Thanks!

Wow, so many people (including myself) are needing to hear these tips, especially right now! I didn’t even think about negotiating my credit cards interest rate so will need to look into that. Thank you so much!

Thanks Lucy!

Great tips. Used many of these knowingly and unknowingly. Thanks for sharing.

Thanks Sabrina!

These are such awesome tips to help one climb out of debt. Thank you for sharing!

Thanks Alyssa!

Needful content. Keep creating content like this! Tons of love for you

Thanks!

These are some great tips! I really liked how you added how much coffee could end up costing you!

Thanks Grace!