This article may contain affiliate links. I might earn a small commission if you make any purchases through my links and it comes at NO cost to you. For more information, please read my Disclaimer page.

When it comes to your investments, let’s face it – you would want to maximize every dollar of your hard-earned money! One such concept/strategy that will help you achieve this goal is dollar-cost averaging.

The strategy of dollar-cost averaging comes in real handy when the financial markets are volatile. If volatility is high, it is extremely difficult to buy and(or) sell your stocks at the desired price.

When executed properly, this strategy can provide a significant benefit to your portfolio.

How?

The idea behind dollar-cost averaging is that you keep buying small chunks of investments over time, especially when the market is declining. This will ensure that your buying price smooths out over time.

Download FREE Budget Checklist

>> 50+ List of Budget Items

>> Budget Items categorized into 3 sections: Income, Fixed Expenses, Variable Expenses

What Is Dollar-Cost Averaging?

Dollar-cost averaging is a technique of building wealth slowly and steadily. Particularly, if you are just getting started with investments, it will help eliminate decisions driven by emotions.

So, lets break down the term in simpler terms.

The term, Dollar-cost refers to the cost of your dollar – in other words, how much are you paying to buy an investment. “Averaging” is taking the average of all your investments.

For example, if you buy 2 shares at $100 (100*2 = $200) and another 2 shares at $90 (90*2 = 180), your dollar-cost average on the 4 shares is: 200+180 = 380/4 = $95/share.

As you can see, because you bought the latter 2 shares at a lower price (than the initial $100 price), your overall cost of ownership/share is lower.

How To Use The Dollar-Cost Averaging Method?

In the investment world, there are multiple techniques for maximizing your money. This strategy happens to be a straight-forward one.

Depending on your investment schedule, the approach will vary. But, the idea is to keep buying smaller chunks of stocks, ETFs, etc., at regular intervals. Irrespective of the market fluctuations, you set aside a fixed dollar amount to purchase your investments.

The question then is what about the number of shares?

In this technique, the number of shares will fluctuate depending on the share price. If the share price is lower, you get more shares for your money and vice versa.

So, over time your overall share price is going to be lower with this strategy.

How Is Dollar-Cost Averaging Calculated?

Now, let’s look at a real life example!

Suppose, you have $5,000 to invest in a company whose stock is at $100. So, you buy the shares of the company and invest the entire $5,000. Based on the share price and the amount, you get $5,000/$100 = 50 shares.

Now, we will look at 3 market scenarios and determine the impact of your initial $5,000 investment.

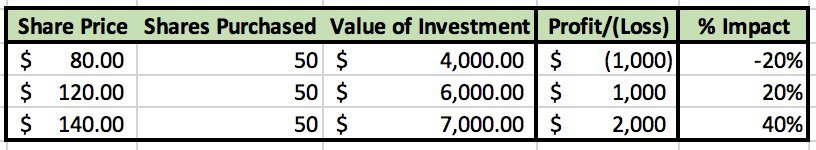

Scenario 1: A Lump-Sum Purchase

When you make a lump-sum purchase, you are buying as many shares as you can for your total investment amount. The anticipation is that the price of the company stock will increase and you will profit on your initial investment.

As you can see, the higher the stock price from the base price of $100, the more you profit on your investment. At $120, your initial investment of $5,000 is worth $6,000 and you make 20% returns on your investment.

And, at $140, your returns on investment is $2,000 or 40% – that’s huge!

The lumpsum purchase method is one of the most common purchasing methods out there. Generally, Wall Street trading firms use this method when they anticipate higher returns in the short-term. This is one of the most effective methods to ensure a higher return on your invested capital in the short-term.

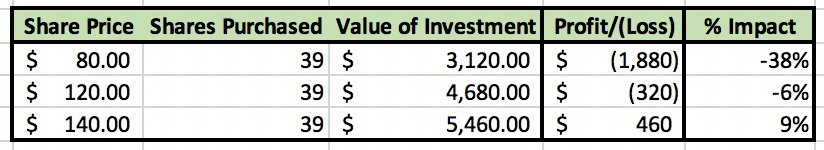

Scenario 2: Stock Market Is Bullish (Rising)

A bullish market is where the price of the company shares are rising. This is particularly good for your overall portfolio as it increases your total wealth.

In regards to dollar-cost averaging, a bullish market is good from a long-term perspective rather than short-term. Assuming that our base stock price of $100 is increasing, you keep buying shares of the same company in 3 equal chunks at $115, $125 and $140. At these prices, your $5,000 will yield 14, 13, and 12 shares respectively for a total of 39 shares.

As you can see, in a rising market, to get a higher return, the stock price has to grow significantly higher than your original investment of $100 for you to make a good return.

This is one of the reasons why dollar-cost averaging works better in the long-term vs. short-term.

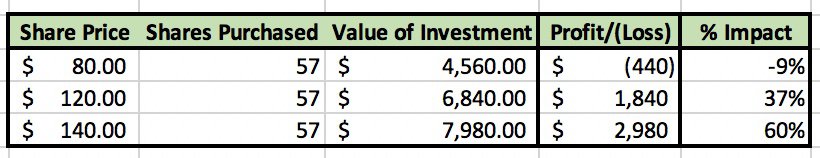

Scenario 3: Stock Market Is Bearish (Falling)

A bearish market is where the price of the company shares are falling. This is particularly NOT good for your overall portfolio as it decreases your total wealth.

In regards to dollar-cost averaging, a bearish market is really good from both the long-term perspective and short-term. Assuming that our base stock price of $100 is decreasing, you keep buying shares of the same company in 3 equal chunks at $90, $70, and $60. At these prices, your $5,000 will yield 19, 24, and 28 shares respectively for a total of 57 shares.

As you can see, in a bearish market, you can acquire more shares and once the stock market turns bullish (rises), your profit potential is much higher vs. scenario 2.

Again, dollar-cost averaging works its magic in a long-term environment rather than short-term.

Related Article: 7 Types Of Investments For Beginners

Benefits Of Dollar-Cost Averaging

- The number one advantage is the opportunity to buy more stocks in a bearish (falling) market. This ensures that you are maximizing your dollar value.

- You incorporate discipline in your investment strategy – rather than making decisions on the fly, you have a strategy you are executing against.

- Leave the emotions at the door – countless investors have lost a good chunk of their fortunes by being greedy and impatient so dollar-cost averaging helps you eliminate your emotions when making investment decisions.

- Helps you buy stocks when the prices are lower rather than higher. When investment decisions are driven by emotions and fear, most likely you’ll lose your hard-earned money. A defined strategy like the dollar-cost averaging goes a long way in building a successful investment portfolio.

- This strategy will also protect you from market volatility during uncertain times.

Drawbacks Of Dollar-Cost Averaging

- This technique reaps benefits in the long-term – so if you are looking for short-term gains/profits, this might not be the right strategy for you.

- If the stock price does not rise over time, you won’t see the return on investments as you expected.

- This strategy requires a lot of patience when it comes to buying and holding the stock. You will need to train your mind to wait until your target price before selling.

Related Article: Safe vs. Risky Investments

FREE Emergency Fund Tracker!

Life is full of surprises, so why not build an emergency fund that can help you when you need it the most. Learn how to build a $1,000 fund in 77 days.

Final Thoughts

Dollar-cost averaging technique is one of the most popular strategies with investors. The reason being, it offers the discipline of buying more when the prices fall so you can maximize your investments.

In addition, this technique eliminates the emotions you run into when money is involved especially, greed and fear. Once you set up your trades, depending on the market movements, the transactions are going to be executed automatically.

The most important benefit of dollar-cost averaging is evident over the long-term when the stock prices are higher and you can make a higher return on your investment. So, if you are risk-averse and prefer minimal losses, the dollar-cost averaging technique can provide much-needed diversity to your investment strategy.

What are your thoughts on dollar-cost averaging? Do you use this technique? Please share your experience, thoughts, tips, and ask away any questions in the comment section below!

This is a very interesting concept I had never heard of before. It is something worth looking into. Honestly everyone should start investing in SOMETHING for the future, because the government won’t take care of us by the time we retire. Thanks for sharing!

Thanks Ry for sharing!

Thanks for sharing the concept of Dollar Average. It made sense, other methods of investment could include property investment, but it will need a lump sum investment and holding power.

Thanks Bee! Yes, property investment often requires lump sum amount.