This article may contain affiliate links. I might earn a small commission if you make any purchases through my links and it comes at NO cost to you. For more information, please read my Disclaimer page.

I am almost certain that this is not the first article on the personal finance tips that you are reading. There are numerous articles with tips, tricks, and other information out there. But, this article focuses on the absolute must-haves to help you set a strong foundation for your personal finances and build upon it.

Countless folks either do not know about these basic tips and must-haves or have not yet ensured that it is part of their financial plan.

And, I would hate to see you make the same mistake!

So, let’s look at these 20 must-have tips that you can incorporate in your life and create a strong personal finance foundation.

The Basics

1) Set Your Financial Goals

One of the most common personal finance tips includes setting a financial goal. Goal setting is crucial to your financial well being as it helps you move toward a particular target ( in this case a number). If you do not have a financial goal, it will be difficult to gauge the progress and missed opportunities.

To begin with, I would list all the possible financial goals that you would like to accomplish – in other words, a simple brain dump. Next, you can filter your goals one at a time and come up with a final list of your financial goals.

2) Create Short-Term And Long-Term Goals

Once you have the final list of your goals, segregate them into a short-term and a long-term list. Short-term can be up to two years and long-term can be up to ten years or more.

Remember, your short term goals provide the necessary traction to fuel your long-term goals so revisit your goals at least quarterly.

3) Open More Than One Bank Account

You need to take advantage of the “new account” offers from various banks out there. Because of the competition and increased supply, banks are coming up with innovative offers to lure new customers.

Open up at least a couple of bank accounts (with regular checking and savings accounts) for your day to day needs. Ideally, I would recommend at least 2 checking and 2 savings accounts to begin with. Plus, you can easily have more than 3-4 investment accounts with different brokerages to save money.

You see, each of the banks/brokerages, have their fee structure, maintenance fees, and account management fees. Also, they offer perks in terms of NO commissions on trades.

4) Track Your Net Worth

Another popular personal finance tip is to track your net worth. When it comes to your finances, it is imperative that you understand your current standing so you can plan your future.

One of the ways is to track your Net Worth which is basically the difference between your Assets (includes your income, investments, properties, etc.) and Liabilities (includes, expenses, debt, etc.)

You can track this amount any number of times but do it at least once a month. It can highlight red flags about your financials in terms of incomes, expenses, debts, savings and investments. On the flip side, it can also highlight your progress and how you are tracking vs. your financial goals.

Manage Your Money Through Budget

5) Your Reason To Budget

Your reason for budgeting and managing your money is the driving force that will ensure the continuity of the process. To me, this is the most important of all budgeting tips.

If you are budgeting because someone told you to or you read it somewhere that it is good for your finances, chances are you will not be consistent and the process won’t help you.

Instead, think about the end goal you’re trying to reach. Align the budget process with your burning desire to become debt-free, save more, invest and grow your money. No matter what your end goal is, your reason to budget should inspire you.

One of the other reasons why people budget is to solely get their spending habits under control. Another reason is to pay off student loans or credit card debt or both. Or, maybe you are getting married or having a baby.

See the point?

Once you align your budgeting process to your end goals, you will be amazed by how your spending habits will change and fall in line with your goals.

Download FREE Budget Checklist

>> 50+ List of Budget Items

>> Budget Items categorized into 3 sections: Income, Fixed Expenses, Variable Expenses

6) Choose The Right Budgeting Method

Selecting a budgeting method that works for you and your household is of utmost importance. Do not choose a budgeting method because it is more popular.

There are 4 main types of budgeting methods:

- 50/30/20 Budget: This is the most straightforward budgeting method. The idea is to segregate your expenses into 3 categories: 50% for all your needs, 30% for discretionary and 20% for paying off debt and saving.

- Zero-Based Budget: One of the most popular methods is a zero-based budget. In this method, your budget at the end of the month should be zero. Meaning, every expense that you anticipate is assigned a category and planned for. This reduces the room for error.

- Envelope Budget: This method is similar to the zero-based budget except that it only deals with cash. You allocate cash for your monthly expenses into envelopes. For example, if you allocate $600 for groceries, you put $600 cash into an envelope and only use that envelope for grocery shopping.

- Pay-Yourself First Budget: In this method, you pay yourself a set percentage or amount first from the income you receive. This ensures that you have some savings at the end of the month.

If you are budgeting to pay off your debt, save money or want to invest and grow your money, the zero-based budget method is the one.

Why?

Because it is a detailed method that will not only give you valuable insights into your spending habits but also aligns your money with your long term financial goals.

Related Article: What Is A Zero-Based Budget

7) Create A Budget Template

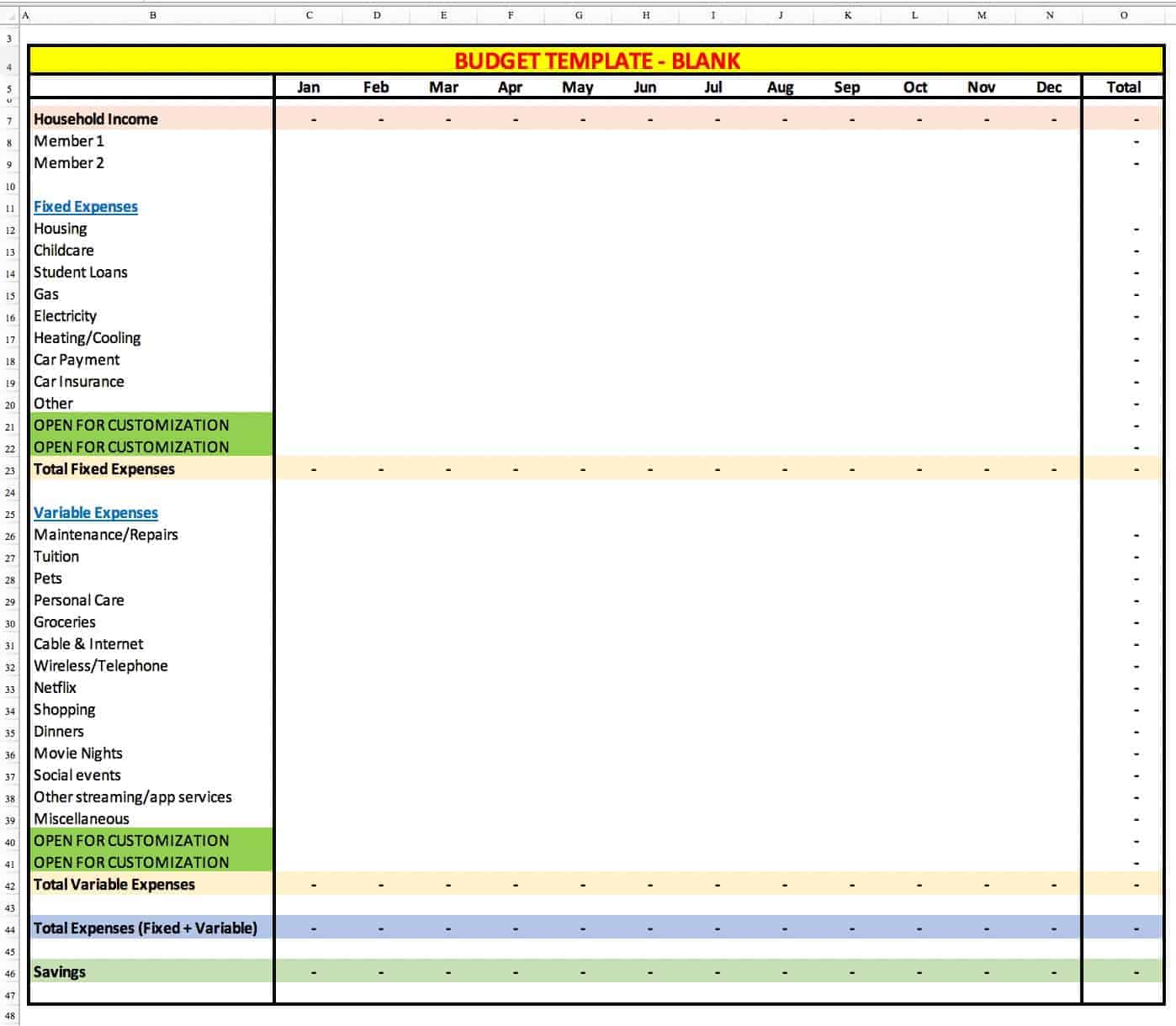

A budget template is something that helps you track your spending and gives you a monthly snapshot of your income, expense, and savings. So, of all the personal finance tips, this will lay the foundation for your money management process.

Create a detailed template where you can identify all sources of your household income, list all monthly expenses, and ultimately determine your savings.

Here’s how you can approach this:

- Plan out your total household income. This should include every source of income (regular or irregular) you earn in a given month. Include the income from all jobs (if more than one), monthly investment income or dividends, income from side gigs, tuition, music lessons, bar-tending, etc.

- Next, plan your fixed expenses. These are the necessities of life that you cannot live without and includes expenses for Rental, Mortgage, Childcare, Student loans, Gas, Electricity, Auto loans, and insurance, etc.

- Next, its time to plan those expenses that are not necessities. In other words, you can manage to either live without them or reduce your spend if need be.

A simple template like the one below should be good enough to put your numbers together.

8) Track Every Dollar You Spend

If you want to avoid the debt trap you need to know your numbers (finances). Also, you need to be prudent about how much are you spending and where are you spending your money.

Countless folks I know, either do not have a budget or are not tracking their monthly spend. The easiest way to end up in a debt trap with no savings is to not track your daily spend.

I know what you must be thinking – track every purchase I make?

YES!

And there are countless tools/apps available to make your life easy.

Personally, I have tried recording the daily expenses in tables that I drew on notepads, using excel spreadsheets, the “notes” app on the phone, to using budgeting apps like Mint and good budget.

But a couple of years ago, I came across an app called the “Spending Tracker.” It has 4.5+ stars and over 4,400+ reviews.

I gave it a shot and just fell in love with the user interface and simplicity of using the app. It is super intuitive and you will be an expert user in no time.

Download the app on iTunes here (not an affiliate link).

Download the app on Amazon here for Android (not an affiliate link)

9) Budget Consistently With A Long-Term Focus

One of the effective personal finance tips is consistency with your budget process.

If you push yourself to track expenses daily, it will become a habit after 66 days. Being consistent with anything for that matter will yield results – may it be studies, sports, business, gym or any area of life.

Another key budgeting tip is to have a long term focus. If you are pre-determined to just test it for a few days, it’s not going to help you. Having a long term focus gives you and your budget enough time to make the necessary adjustments and bring your spending in control.

Similar to the fact that it would be almost impossible to lose 100 pounds in 5-10 days, your budget is also going to need some time.

The best way to learn is by making mistakes (which you will initially) with your budget expenses, so don’t beat yourself up and be patient.

How To Maximize Your Savings

10) Save To Build An Emergency Fund

Building an emergency fund is key to saving money.

How?

If you do not have an emergency fund, in case of emergencies, you will have to dip into your hard-earned savings to cover expenses. This will lead to reduced savings instead of the other way around.

Given the very nature of emergencies, no one would willingly ask or wish for it, yet, most of us ignore planning for it and creating a separate fund that can be a life savior in those difficult times.

I was guilty of doing the same until I got my act together and consciously started setting aside money for emergencies.

Emergency Fund Tracker!

Life is full of surprises, so why not build an emergency fund that can help you when you need it the most. Learn how to build a $1,000 fund in 77 days.

11) Move One-Time Income To Savings

If you receive a one-time additional income (something you were either not expecting or did not plan for) move the money to a savings account or emergency fund.

This will help you gain some cushion in terms of your savings. It will not force you to dip into your investments to cover a significant expense.

Follow a similar approach if you receive an inheritance or a windfall. Move part of the money to a “money-market” account – some to a savings account, some to investment accounts and college funds.

You will be at peace when you have cash in a dedicated account, so there is no confusion where to go when you need extra money.

12) Refinance Your Mortgage

Refinancing your mortgage is one of the best options to save money out there in my view. The amount of money you save in the long term is significant.

You should always be on the lookout for better rates to refinance your mortgage.

When the interest rates are lower, refinancing is generally at its peak. This leads to competition among mortgage lenders and will result in better options for homeowners.

You can leverage this market demand and supply and get a better refinance rate and save significant $$ monthly.

13) Save On Home Insurance

In addition to refinancing the mortgage, you should also reach out to your current insurance provider for better rates.

Because of the competitive insurance market, insurance companies will work with you and usually go the extra mile to make things work.

They also have BUNDLE options: meaning if you have your auto insurance with them, they offer discounts to add on (bundle) home insurance.

Most of the insurance companies offer bundle discounts and you can easily save money with this option.

14) Save On Renter’s Insurance

Renter’s insurance can come in really handy should you encounter theft at your apartment. It covers a range of causes from break-ins to natural disasters. But, above all, it covers medical bills and other expenses crucial for your recovery.

In addition, in most cases it also covers your items stolen. On average, this type of insurance is not expensive and one can usually find starting prices for as little as $20/month.

Related Article: Money Mistakes To Avoid

How To Avoid The Debt Trap

15) Use Cash For Purchases

I want to start with a caveat – if you think you are not good with credit cards, this is the option for you.

A lot of people use this as a go-to option for their everyday expenses. Some of my close family members and friends use cash and it works for them.

The idea is every week, you go to the bank/atm and withdraw a set amount of money. You use this for groceries, lunches, gas and other daily expenses.

The option to use cash prevents you from making unwanted purchases through your credit card. There are so many stories where people were able to cut down their expenses, save money and even pay off their debt by simply using this option.

There is certainly no harm in trying out this option if you haven’t already. If it helps to stay on track with your expenses, then you are in business.

Download FREE Budget Checklist

>> 50+ List of Budget Items

>> Budget Items categorized into 3 sections: Income, Fixed Expenses, Variable Expenses

16) Pay Your Credit Card Balance In Full

Paying off your monthly credit card balance in full is a single most crucial aspect of financial independence, in my opinion.

Why?

If you do not pay the balance in full, you incur interest charges on the purchases.

In the next monthly cycle, you will have to clear not only the current month balance but also the remaining balance from the prior period PLUS the interest charges.

Paying just the minimum payment due is NOT enough and is one of the myths of having a credit card that you need to understand.

17) Focus On Paying Off Your Student Loans First

Student loan debt has been increasing at a staggering pace in the past decade. More and more students are graduating with higher student loans and struggle to save money.

According to Investopedia, there was a research study by The College Board in 2019, and here are the findings:

- Total outstanding student debt reached $1.4 trillion in 2019

- The average student loan balance per borrower also hit a record high of approximately $36,000

- 54% of students borrow money (get in debt) in the form of student loans and(or) pay for other college expenses

Think about the above statistics for a moment…

Right out of the gate, the college graduates are being set up for failure. The jobs out of college do not pay nearly enough to cover rent, food, car, insurance, student loans, and other necessities in life.

This leads to more borrowing through credit cards and it becomes impossible to save and invest your money.

So, if you have student loans, pay it off as soon as you can before saving for anything else.

How To Invest and Grow Your Money

One of the popular and effective personal finance tips is to invest your money so it can work for you. If you’d like to achieve financial freedom sooner rather than when you are in your 70s, investing your money to grow at a faster rate is absolutely crucial.

The world of investments can be tricky and people are either too scared to invest or way too conservative when it comes to investing.

One common reason for this is the lack of knowledge and understanding of how investments work. So, before you start investing, you need to understand these 3 key aspects (or tips).

18) Know Your Risk Appetite (Tolerance)

You need to know your risk appetite. This is the key! Not everyone is the same, and hence you need to cater to your investment choices based on your risk appetite. Thanks to Schwab, you can find your risk tolerance level here. Once you know your risk tolerance level, you can look into company stocks that fit your style and goals.

19) Compounding

Compounding is a process in which you take the returns from the investment and re-invest it. In other words, the amount you gained helps you earn even more.

Example: Let’s say you invested $100 at 5% return for 1 year. At the end of 1 year, you will receive $100 + ($100 * 5% = $5) = $105. Next, you invest the entire $105 at the same 5% return for another year. At the end of year 2, you will receive $105 + ($105 * 5% = $5.25) = $110.25 and at the end of 10 years, it will be $162.89.

20) Diversification

Even if you are new to investing, I am sure you must have heard the saying: Never put all your eggs in one basket. Diversification is precisely that – do not put all your money in only stocks or bonds or mutual funds or ETFs.

You need to spread out your money into different investment options. All your investments collectively will make your Portfolio. Your goal should be to never allow any single investment option to create an unhealthy balance that can impact your overall portfolio return.

BONUS Personal Finance Tips

Do NOT Compare Your Finances With Others

One of the common issues you will run into is to compare yourself financially with someone else. It is human nature so even if you don’t like the thought, it is still going to pop up and you’ll have to address it.

Do NOT compare your financial status with anyone (better or worse) and stay focused on your financial goals.

Life happens to every individual in different ways so do not try to reason your current financial standing with that of someone else’s.

Educate Yourself Consistently

One of the personal finance tips you’ll hear from successful folks is to educate yourself. Education does not stop at college and you need to constantly invest in yourself as you go through life.

The topic of personal finance is no different, so focus on learning about savings, debt, budgeting, money management, investing, etc. as much as you can.

It will help you make better and smarter money decisions in your life that could change the course of your financial future.

Download FREE Budget Checklist

>> 50+ List of Budget Items

>> Budget Items categorized into 3 sections: Income, Fixed Expenses, Variable Expenses

Final Thoughts

If your goal is to be debt-free and financially independent, you will have to incorporate these personal finance tips into your daily life.

There is no shortcut to achieving your financial freedom and the sooner you develop an action plan to fulfill your financial goals, the better.

The personal finance tips discussed in this article will undoubtedly help you lay a strong foundation that you can build upon in the future!

What personal finance tips do you use? Please share your experiences, thoughts, tips, and ask away any questions in the comment section below!

Hi Sam,

I agree 100%. You’ve covered the most important parts at the end that not many people don’t talk about – not comparing your financial journey with others’ and consistent learning. Very thorough post that even covered compound interest. Yay!

Cheers,

Corinne

Thanks Corinne for your kind words ????

What a fantastic list! Pinned for later, these are so helpful and thorough! Thank you!

Thanks Ariana ????

There are so many great tips in here! I’m starting with opening a new bank account and then going down the list. So perfect for my new 2020 budget. Thanks!

Thanks Jen!

The power of compound interest is huge! I wish I would gave learned about it years ago!

I agree Kari! It can make a huge difference in your net worth.

I’m trying to stick to a budget this year and it’s not easy!! So I’ll take any advice I can get!????. I have to admit I do like learning about finances and how to manage them ☺️

Thanks Megan! Yes, it is not easy to stick to a budget but that is the whole purpose. If it does not hurt, you aren’t making progress. You will feel great once you see those savings in your bank account from your “sticking to the budget ” effort. It’s the first step toward your financial freedom so keep pushing yourself even if its tough.

I really appreciate the different budgeting methods you present in the article! I actually had no idea there were different ways to do it.

Glad you found it helpful Jennifer!

Awesome tips here Sam! I think having a financial goal and taking action towards that goal is very important to improve/enhance one’s financial situation.

Thanks!

Great tips, Sam! I think having a financial goal and taking action towards that goal is very important to improve/enhance one’s financial situation.

Thank you!

Great tips!

Thanks!

Great article! Very thorough and can work for anyone, not just millennials! Thanks for sharing

Thanks Eric!

There are so many great tips here! Thank you for this. I will be referring to this often. Pinned for reference as well.

Thanks Lina!

I find this post very easy to follow, yet filled with all the information one needs to build a solid financial future. Thank you for your work!

Thanks Serena!

Excellent article! Keeping track of every dollar spent is EXACTLY how my husband and I are debt free, mortgage free and have saved well over $180,000. People normally don’t realize how much money they are wasting on “little things.”

I love your advice!

Thanks Lindsey! Good to know you and family are debt free. Congrats on that achievement!

Lots of great advice. Setting financial goals and budgeting are hugely important in getting your finances on track.

Thanks Russell

Amazing tips! I gotta say, planning your financial goals is key, anybody can save money, but reaching a savings goal for a reason is much more satisfying

Thanks John!

Wow what a detailed and amazing article!!

Thanks Bridget!

Very comprehensive list! Do you have a link to share that Budget Template? I would argue against 17) Focus On Paying Off Your Student Loans First. Assuming the interest rate is <7%, that is actually considered good debt and won't hinder your credit score. There is nothing wrong with saving for a 20% house down payment or 3-6 month emergency fund first.

Thanks Sarah! I don’t have a link as that was a picture from excel. Students loans generally have higher interest rates and the sooner you pay it off, the less burden when you want to buy your first home or make larger purchases down the road.

Very well written and simple to understand!. Thanks for sharing!

Thanks Chandra!

My wife and I have keep a monthly budget for the last 7 years, and it has been a game-changer. Our template combines zero-based budgeting with pay-yourself first budgeting. Great post with great advice for those seeking!

Thank you for this informative post. I have quite a few plans hope to get them to fruition.

Thanks Shwetha!