This article may contain affiliate links. I might earn a small commission if you make any purchases through my links and it comes at NO cost to you. For more information, please read my Disclaimer page.

A credit score is a number that determines how likely you are to pay off your debt. In other words, it evaluates your worthiness to acquire credit from lenders.

Fair Issac Corporation (or FICO) first created the scoring model, and it is widely used by the financial institutions today. Also, FICO has become the go-to method for most lenders to determine your ability to repay debt.

Achieving and maintaining a good credit score takes some work, but with a clear action plan, you can surely make it happen.

Credit Score Range

Depending on your credit usage and payment history, your score could be either on the higher or lower side. Since every lender has their individual ranges, the FICO score range is averaged.

The average FICO score range is:

- Poor: 300 – 579

- Fair: 580 – 669

- Good: 670 – 739

- Very Good: 740 – 799

- Excellent: 800 – 850

As you can see, the FICO score ranges from 300 – 850 and where you land on this range depends on 5 main factors (which we will get to in a bit)

But first, what does it mean to fall in any of the above ranges?

- Poor Credit: In this range, it is challenging to qualify for the credit, and in case you do, you’ll pay a fortune on the interest rates charged

- Fair Credit: It is a little easy to qualify for credit in this range, but you’ll pay higher interest rates. Also, there are limited credit card choices for you.

- Good Credit: Life gets a little easier if you have good credit. There is more flexibility for you, and you’ll pay lower interest rates compared to fair and poor credit score ranges

- Very Good Credit: In this range, you’ll have access to those elite rewards and travel credit cards with higher credit lines and lower interest rates

- Excellent Credit: This is where there is no restriction on any credit card you want (with an unlimited credit line option available) and the lowest interest rates offered.

So it is very important that you have a good credit score to qualify for credit with a lower interest rate.

How Is Credit Score Calculated?

The exact calculation is not available publicly, but FICO lays out the 5 main factors that determine your credit scores.

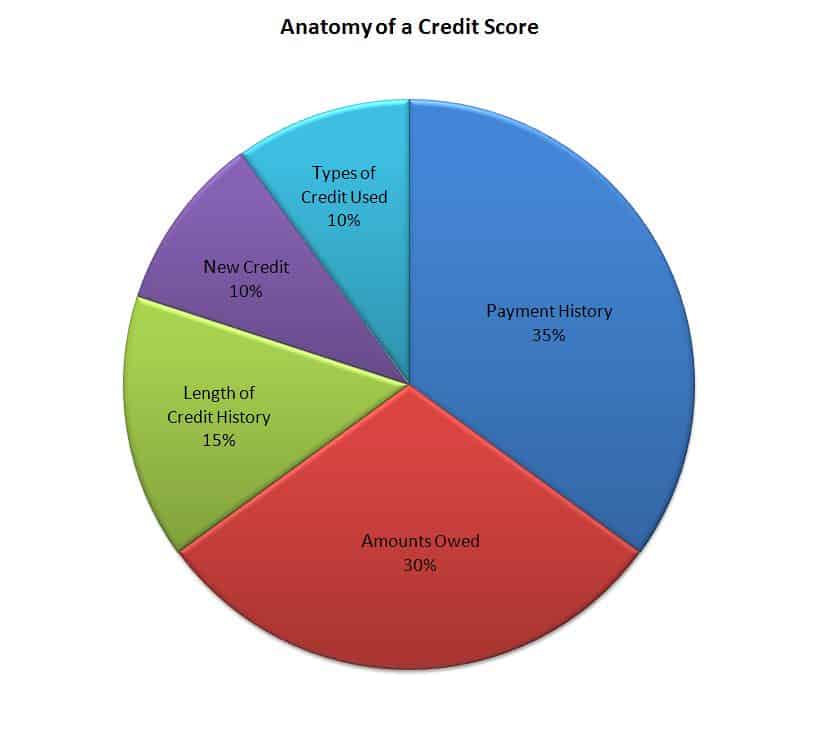

Take a look at the below chart…

Credit scores are provided by 3 major credit bureaus: Equifax, Experian, and TransUnion. Yes, that’s correct – you have 3 credit scores!

There is no compulsion for a lender to use all 3 scores. Some use all 3, while others can use 2 or even 1. Also, a lender might prefer one credit score over the other.

Why?

If you’re going to need an auto loan, the lender might consider one of the scores that have more emphasis on your payment history related to auto loans. Most commonly, the lenders use an average of all 3 scores.

There are 5 main factors that determine your credit score:

1) Payment History

These are the on-time payments you make every month. As seen in the chart, it is the most important factor with 35% weighting.

So why is this factor the most important in determining a good credit score?

Your payment history shows a lender how consistent have you been with your payments. It highlights the fact that you can pay the monthly amount in full and there a no delayed payments.

Furthermore, it also highlights late payments, delinquent accounts, closed accounts, and collection issues if any.

In other words, payment history is going to give a clear picture to the lender if you are a prime borrower (with a Good or higher credit score) or a sub-prime borrower (with either Fair or Poor credit score)

2) Available Credit

Available credit is the “credit limit” you have as a borrower. As seen in the chart above, this has 30% weighting and is the second most important factor.

The lender uses this factor to determine how responsible you are with your credit limit. If you’re using too much or close to all of your limit, you’re at risk of missing payments.

The ideal credit limit usage is around 25% – 30% – I keep it at 20%!

This means that if you have a credit limit of $1,000, for example, do not put more than $300 on your credit card in a given month.

Pay off the $300 in FULL when it is due and keep repeating the same process every month. This will allow you to build a good credit score in a healthy manner without falling into the debt trap.

If you’d like to learn more about credit card usage, check out my article on how to use a credit card wisely.

3) Length Of Credit History

As seen in the chart above, the length of your credit history has 15% weighting. The lenders like to see how long have your old and new accounts been open.

Why?

So that it ties into your payment history and shows your track record of monthly payments.

The longer the various accounts are open, the better the history you build and the easier it gets to qualify for new credit cards and loans.

4) New Credit

As seen in the chart above, new credit has 10% weighting. This option tells a lender how many new accounts have you opened recently.

If the new accounts are less than a year old, it impacts your credit score.

Also, if you opened 2 new credit card accounts in less than a year and are applying for a 3rd credit card, that is a red flag to the lender.

The reason being, it gives them the impression that you are in some sort of financial trouble and in need of additional credit that you might not be able to repay.

5) Types Of Credit Used

Last but not least, your credit score also considers the types of credit accounts you have.

The 3 credit bureaus consider this in their calculation of your credit score, so you have to be cognizant of the fact.

The accounts could range from credit card accounts, student loans, mortgage loans to personal and auto loans.

What A Good Credit Score Can Get You

Let’s be honest – why live with a bad credit score when you can manage to achieve a good score?

There is no need to.

You should always push yourself to achieve a good or a better credit score as the benefits of doing that can have a significant impact on your financial health.

So, what exactly do you get with a good credit score?

Lower Interest Rates

Every time you are out looking for auto insurance & auto loans, opening more credit card accounts, renting an apartment or applying for a mortgage, your credit score plays a key role.

You can get lower interest rates if you have a good credit score.

The money you save on interest rates can go a long way in managing your daily expenses.

Also, if you have a good credit score, you have more negotiating power, and you need that – trust me!

Higher Probability Of Approval

Your credit scores will directly influence your probability of approval. Lenders consider a multitude of factors apart from your credit scores, so there is no guarantee of approval even if you have a good credit score.

But, a higher probability is always better than a lower one.

If you are in need of opening a new credit card account or have to buy a car, the higher probability of approval can really help.

Higher Credit Limit

If you have a bad credit score, the option to either get approved or increase your current limit almost does not exist.

The reason being, the lenders’ factor in the credit scores when making that decision. The lenders look at your payment history, and if they do not get the comfort in the fact that you can pay off what you have borrowed, they will not extend you higher credit limits.

So it is in your best interest to maintain a good credit score.

No Security Deposit Required

A bad credit score will put you at a disadvantage when it comes to borrowing almost anything. You will be required to put in a deposit of $100 or even higher if you want to open a new credit card account.

It can be a challenge even if you want to buy a new phone or a wireless plan.

If you have a good credit score, there is no security deposit required. That’s a huge relief!

Save Money

This is one of the most significant advantages, in my opinion. If you have a bad credit score, you’re going to pay higher interest rates.

For example, if you have a $300,000, 30-year mortgage at 4% interest with a good credit score, you end up paying approximately $215,000 in interest. If you have a bad credit score and get a 5% interest rate, you end up paying approximately $280,000 in interest over 30 years.

That is $65,000 more because you had a bad credit score.

On the other hand, you could save that $65,000 and put it toward your college, pay off student loans, or invest and grow that amount over the years.

If you’d like more ideas to save money, check out my article on 25+ creative ways to save money.

How To Get A Good Credit Score

There are a few things you can do on a consistent basis to maintain your credit score. Remember – the key to your success regarding a good credit score is being disciplined and consistent in your approach.

1) Understand Your Spending Habits

Back in school & college, if you were to participate in any event (sports, music, theater, etc.), you would first understand what it took to succeed and follow the routine consistently.

In the same manner, to get to a good credit score, you first need to understand your spending habits that are impacting your score currently.

Focus on tracking your monthly spend. Once you know where and how are you spending your money, you can come up with a plan to tackle your expenses.

2) Percentage Of Credit You Use

Once you know your monthly spending, figure out how much of your expenses are paid in cash vs. credit.

Ideally, your credit usage on the total credit limit (between all credit cards you possess) should not exceed 30%

So if you are using 40% – 50% of your credit limit, reduce your credit usage to under 30%. I always keep it around 20%. Also, according to Investopedia, keeping it around 20% will boost your credit score.

3) On-Time Bill Payments

Hands down, your on-time monthly payments will make or break your credit score.

If you’re late on your payments, your credit score is going to take a hit. It sends a message to creditors that you are not able to pay off your debt on time.

Also, the other implication is that you are borrowing more than what you can afford – an absolute no-no in lenders’ eyes.

So, no matter the case, make sure your monthly payment is on time.

4) Pay Your Balance In Full

Paying your balance in full will absolutely boost your chances of maintaining a good credit score.

Do not fall into the trap of the minimum monthly payment. That is the easiest way to sabotage your effort to build your credit score.

The minimum payment option serves the creditors more than you, and it sends a red flag that you are might be experiencing financial trouble.

Always, pay your monthly balance in FULL.

5) Do Not Close Old Accounts

If you recollect from the chart above, the length of your credit history is an essential factor in determining your credit score.

Your history is an indication of your track record with payments, number of accounts, credit usage, delinquent accounts, and collection issues on your accounts.

So the longer the history, the more comfortable the lender will be in offering future credit.

Do not close old credit card accounts even if you are not using them. There is no mandatory rule to close old accounts if not utilized. So take advantage of this fact and keep your old accounts open.

Summary

In order to achieve and maintain a good credit score:

>> You need to make on-time monthly payments

>> Limit your total credit usage under 30% of your total available credit limit (ideally keep it around 20%)

>> Do NOT close older credit card accounts

>> Manage your overall debt (including credit card debt, student loans, mortgage, auto loans, etc.)

>> Pay your monthly balance in full and do not carry forward any balance to the following month

How do you manage your credit score? Please share your experience, thoughts, tips, and ask away any questions in the comment section below!

All good tips. I believe paying the balance in full. It actually makes me think twice when I am making a significantly big purchase.

Thanks Nadia – yes its a good practice to think twice before making a big purchase!

This is such a great and informative post! Thank you so much for sharing. I didn’t know these things about credit score (or anything about it actually) so this was very helpful. It’s so interesting to find out how things work in other countries.

Thanks for the kind words Valentina!

This is really good info and good timing because I had some questions regarding this topic. Thanks for sharing. I’ll be pinning this so I can read again.

Glad you found it helpful Kristina!

Very good tips and advice!

Thanks Denise!

A credit score class should be mandatory for people living in the United States. When I first moved here as an international student, I had no clue and was persuaded to make some foolish decisions by friends. Thankfully, I quickly came to my senses. Your information is critical, thorough and shared in an accessible way.

Thanks Kimberlie!

Very thorough. I don’t think many people realize if they pay cards off, to keep them open because closing them hurts their credit score. Definitely pinning this because you have good info here.

Thanks Ozella!