This article may contain affiliate links. I might earn a small commission if you make any purchases through my links and it comes at NO cost to you. For more information, please read my Disclaimer page.

I’m sure you may have heard about the term “Make your money work for you” and(or) “Grow your money” or maybe other variations of these cliches. Investing in stocks is not complicated but when you are starting out, it can feel daunting.

So, how do you start investing in stocks?

There are certain fundamental steps you need to take in order to start investing. This will help you start your investing journey on the right track.

Investing in stocks as a beginner is more popular than investing in any other asset. The reason for this is that stock investment is simple and straight forward. Once you get accustomed to the jargon, terms, research and the method of buying and selling, you are on auto-pilot for the most part.

Instead of being intimidated, focus on educating yourself and take baby steps. Do NOT rush as investing in stocks and making double-digit returns is more like a marathon rather than a sprint.

Here’s what you do in order to start investing in stocks.

1) Understand Your Current Spending

The first step is to figure out your current monthly spending and savings. It is not prudent to invest before you take care of your debt payments and other necessities like rent, insurance, etc.

So, to understand your current spending, start by reviewing your debit/credit card statements. Segregate those expenses into “fixed” and “variable” expenses. Fixed expenses are those you cannot live without and are necessary for your survival. Variable expenses are those that you can make adjustments to and can live without.

Why is it important to understand your spending?

If you do not understand your monthly finances and the cash inflow and outflow, it will be extremely difficult to set aside money for investments.

This plays into one of the golden rules of investment which is to buy the stocks when they are at a low or the market is down (obviously depending on other market events too). But, if you do not have money set aside for investments, you will lose out on the buying opportunity the market offers.

For this reason, set aside either a fixed % or a $ amount every month for investments.

In addition, if you are not doing this already, start tracking your expenses daily. There are numerous tools available to help you track your daily spending – excel sheet, google sheet, spending apps, etc.

Here are the 5 best expense tracker apps according to US News.

2) Set Up A Budget

Next, set up a budget so that you can track your income, expense, debt payments, savings, and investments if you are not doing so already.

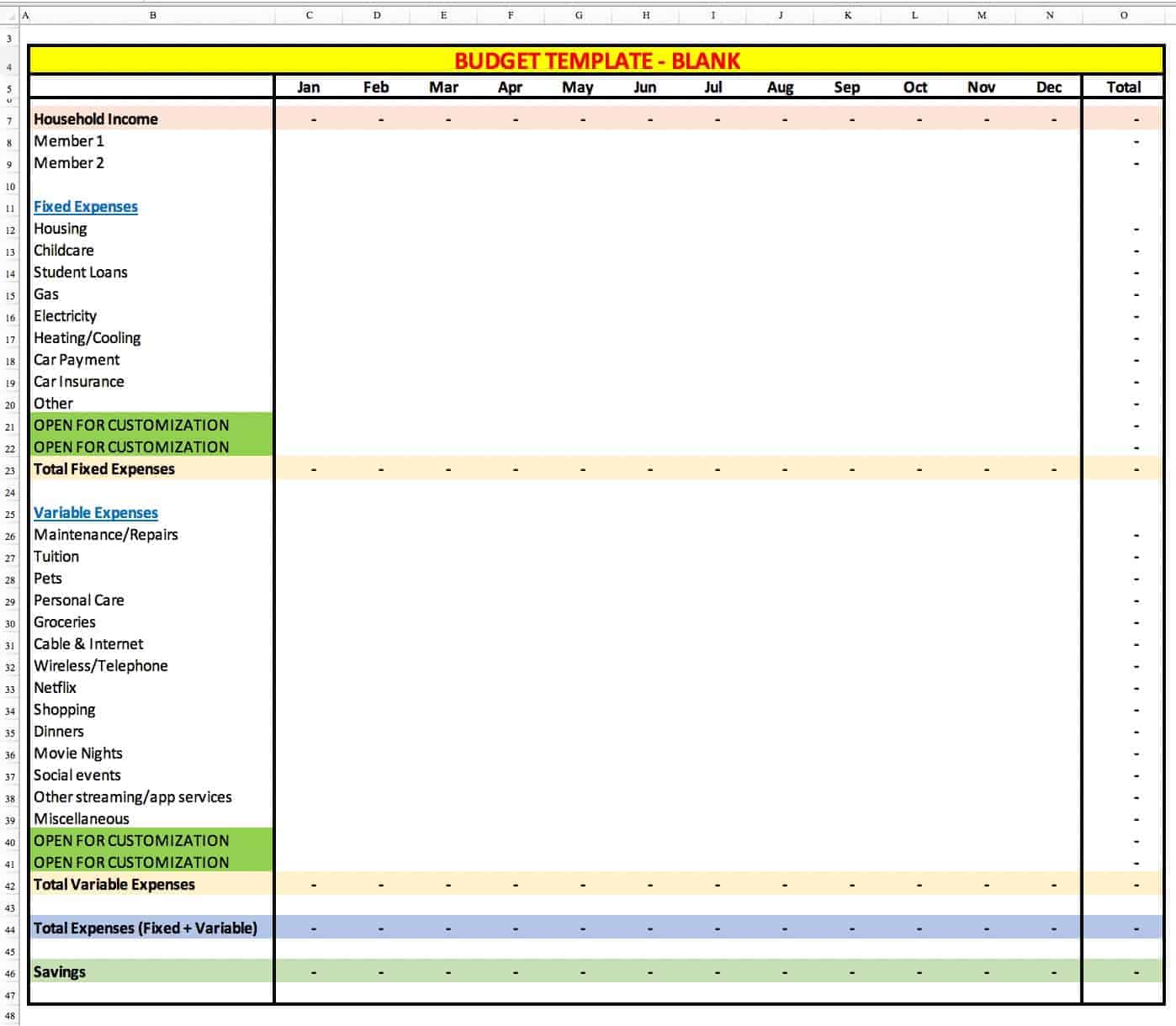

You can create a simple format like the one below. It need not be anything fancy but something you and your spouse/partner understand and can customize. A budget essentially is like a blueprint and is an excellent tool to keep your finances in order.

You can customize the above format to your needs and can add in and delete fields relevant to your situation.

When creating your budget, consider the following:

- Income sources: Whether you are self-employed or working jobs, make sure that the nature of your income is consistent in order for you to start investing in stocks

- Student loans: If you have outstanding student loans, it should be your top priority to pay it off as soon as possible

- Credit card debt: Focus on paying off your credit card debt first before you start investing in stocks. Since credit cards charge astronomical interest rates on unpaid balances, it is financially wise to pay it off first

- Life events: If you are getting married or are about to welcome a baby or anticipating a major life event, wait until after the event to start investing in stocks. You will need additional money for these life events.

Download FREE Budget Checklist

>> 50+ List of Budget Items

>> Budget Items categorized into 3 sections: Income, Fixed Expenses, Variable Expenses

3) Create Your Investment Pool

Once you have your budget squared off, create an investment pool to start investing in stocks. This pool will specifically be earmarked for investments in stocks.

You can simply add a line in your budget (based on the budget template shared above) and allocate money for investments every month.

How Much Money Should I Invest In Stocks?

There is no one-size-fits-all answer to this question. If you are looking to invest in stocks with high growth and high returns, you will need more money set aside depending on your timeline.

On the flip side, if you are focusing on stock mutual funds and income-based stocks, you might allocate a smaller chunk.

Another option would be to allocate a set amount of % or $ every month to your investment pool. Once you reach $2,000 start investing in stocks that fit your portfolio needs and risk tolerance.

How Much Money Do I Need To Invest In Stocks?

The answer to this question will differ from person to person for obvious reasons. Your financial goals, risk appetite, and investment timeline will determine the amount you need to start investing in stocks.

If you are investing in stock mutual funds, most of them have a $1,000 minimum. Also, your investment is spread across multiple stocks in the fund. But, investing in mutual funds is much safer than investing in individual stocks.

If you are investing in individual stocks, you’ll find that the stock prices range from under $10 to over $100,000 in some cases.

For this reason, create your investment pool first (say for example $2,000, to begin with) and then start investing in stocks.

4) Choose A Brokerage Account

If you are just starting out in the investing world trying to figure out the best broker for your investments, chances are that you are overloaded with information and at times confused with the data and jargon at hand.

I’ve been there and can totally relate to it!

As a new investor, your primary focus should be to learn as much as possible. To begin with, educate yourself with various investment terminologies, basics of trading and find the best stock broker that fits your investment needs.

Also, try to segregate information into smaller buckets so it is easily digestible.

Choosing a stockbroker is one of the key decisions you will make for your investments. So, it is important that you take the time to research your options and make an informed decision.

With options abound, try to find a broker that focuses both on education and offers lower fees.

Now, let’s look at the best broker options in the market currently. We will compare the following features across the broker options:

- Education & Research

- Commissions

- Account Minimums and Fees

- Trading Software

Types Of Brokers

The 3 traditional investment brokers I recommend are Charles Schwab, Fidelity, and Etrade. TD Ameritrade was acquired by Charles Schwab in November 2019.

All 3 brokers offer $0 commissions on stock and ETF trades, have extensive educational resources, no account minimums for stock trading and state of the art trading software.

For a more hands-off approach, check out Robinhood, Betterment, and Acorns. These are new generation broker options with robo-advisor services and lower fees.

To begin with, open an account at one of the brokers and start investing in stocks. As you get familiar with the nuances and gain more understanding, you will be able to determine how well the broker aligns with your investment needs.

Once you know the missing pieces, you can look at opening additional brokerage accounts.

5) Define Your Risk Tolerance (Appetite)

Next, you need to determine your risk tolerance to start investing in stocks.

Why?

Because your risk tolerance is going to decide the investment options you choose. You do not want to invest in stocks that are risky and volatile from a risk tolerance standpoint (if you are just starting out).

The hard-earned money that you saved can grow at 7%-8% annually (market average historically) and that add ups in the long run.

From a risk appetite standpoint, not everyone is the same and so you need to figure out your comfort zone.

If you need help figuring out your risk tolerance level, Charles Schwab has helpful resources to get you started.

What Is Risk Tolerance?

In simple words, risk tolerance is your ability to tolerate the degree of variability in investments. It is important because if there are huge fluctuations in the market and you panic, it could hurt your finances significantly.

The timing of buying and selling your investments is key and understanding your risk tolerance is only going to serve you better.

Now, let’s look at the 3 types of risk tolerances.

Conservative Risk Tolerance

Investors that do not like volatility and can’t stomach the constant ups and downs of the market have conservative risk tolerance.

Conservatives do not like investments that are not liquid and prefer guaranteed returns. This reduces the investment options available and the pace at which your money grows is slower than the other 2 types of tolerances.

If you are conservative with your risk tolerance, you can focus on steady income-based stocks that offer dividends.

Moderate Risk Tolerance

If you want to invest money with moderate risk tolerance, you can balance your portfolio by including stocks that are a little more aggressive.

The idea is to figure out which stock investment best suits your style and then pick one or two.

For a balanced approach, you should also include mutual funds so your risk is diversified.

Aggressive Risk Tolerance

To invest money with aggressive risk tolerance, you need to have some expertise with investing. The reason being, the risk levels are high and if it does not align with your income streams and financial goals, you might want to stay away from this approach.

In this approach, you can invest in growth based stocks and volatile stocks. Also, you can derive complex strategies and hedge (protect your downside risk) using a combination of stocks and stock mutual funds.

Remember, the higher the risk, the higher the gain and(or) loss.

Frequently Asked Questions (FAQs)

What are the types of stocks I can invest in?

There are 3 types of stocks you can invest in and they are – Income, Value, and Growth based stocks. Each type of stock has different characteristics regarding investment criteria, company fundamentals, and industry focus.

- Income Stocks: Lower growth potential, least riskier and offer a high dividend yield

- Value Stocks: Average growth potential, moderate risk and also offer dividends

- Growth Stocks: High growth potential, high risk and most do not offer dividends

Related Article: 3 Types Of Stocks To Invest In

How do I choose the stocks I should invest in?

As a beginner, the first step is to track the stocks you’d like to invest on a daily basis. Try to understand the companies, products and how they make money.

Your risk appetite plays a key role in determining the stocks you pick. Conventional wisdom states that as a beginner, you should stay away from individual stocks and invest in stock mutual funds and exchange-traded funds (ETFs).

However, there is no hard and fast rule that you need to follow this approach.

When I started investing, my primary focus was individual stocks. I used to research the company stocks I was interested in, look at prior quarter earnings, read analyst’s price target reports and track the stock market every day.

Remember, your strategy should be to buy the stock and hold it for some time. Companies need time to implement their business strategy and once it shows growth, you’ll see that translate into a higher stock price.

Over time, I diversified into mutual funds, ETFs and index funds.

Should I buy high growth stocks as a beginner?

As a beginner, focus on understanding the stock market and educate yourself with the basics of investing. When you do not understand and invest in something, its gambling. The odds are not in favor and most certainly, you will lose your investment.

Instead, start with a couple of income-based stocks and gain experience on the stock movement, market data, analysts’ opinions and reaction to global events.

How often should you buy and sell stocks?

I strongly recommend a buy-and-hold strategy. In other words, buy the stock and hold it instead of selling it in a month. If you are looking for steady returns of 7%-8%, you need to hold the stock for a longer period of time.

Remember, there is no get rich quick scheme when you start investing in stocks.

Download FREE Budget Checklist

>> 50+ List of Budget Items

>> Budget Items categorized into 3 sections: Income, Fixed Expenses, Variable Expenses

Final Thoughts

To start investing in stocks, create a solid foundation on which you can build your future investments. If your investment approach is not aligned with your financial goals, it will be really difficult to grow your money (and in some cases, it might even hurt your finances)

Make sure you have an action plan and a budget in place. Pay off your student loans and credit card debt before you start investing in stocks.

Create an investment pool that only caters to your investments. Allocate a certain % or $ amount every month toward your investment pool.

Research and educate yourself about the stock market on an ongoing basis and keep experimenting.

How do you plan to start investing in stocks? Please share your experiences, thoughts, tips, and ask away any questions in the comment section below!

I recently read Ramit Sethi’s book – “I will teach you to be rich”. His go to type of investments are target date funds. I actually haven’t heard of those before! What are your thoughts on them?

Target date funds are a good option since they re-balance your asset class over time as the risk tolerance reduces over time. In other words, when you are young, the focus is more on investing in stocks but as you get older, its more towards conservative investment options like income based mutual funds and bonds.They are also popular with 401(K) investors so that is another advantage of having target date funds in your portfolio. Hope this helps. Feel free to reach out if any other questions. Thanks!

Great tips for starting to invest in stocks! One thing to keep in mind is that risk tolerance and risk capacity aren’t always the same. You might feel comfortable taking a certain level of risk but you might need to take a certain amount of risk to reach your goals. And with so many brokers offering $0 trades and low minimums, it’s so easy to get started investing in stocks!

Yes, determining your risk tolerance is tricky and the more you gain experience investing, the better you will understand your risk tolerance. Thanks Rebecca!

Excellent post! You pack a lot in here and manage to explain it in a user friendly way. Thank you!

Thanks Sadie!

Wow, this is great! I have a ton of student loans and I’d love to start working toward paying them off. Thanks for this post!

Thanks Nenia! Definitely pay off your loans first as that will be one step closer to being debt free.

Such an informative post! I’ve been highly considering beginning to invest in stocks so this is actually what I’ve been needing to read! It all seems so complicated still, so I definitely have my research/work cut out for me!

-Madi xo | http://www.everydaywithmadirae.com

Thanks Madi! Take one step at a time and break down the process into bite sized chunks. It does not have to be perfect when you start.

Really great tips for the beginner investor, and a great reminder for the seasoned investor too!

Thanks Bruce ????

So much great and useful information here. I am wanted to start investing next year, that is my goal atleast. I started using acorns last year and I love it. I am hoping financially to be in the position to grow and invest in stocks though.

Thanks Jody. Yes the sooner you start investing the better!

thanks for sharing this! I feel like I have a pretty strong control on my finances and have always been good with spending… the one place i do lack is in stocks (besides my company stocks). It is very confusing and does take some time to learn so thanks for this helpful post!

I have always thought about it but never knew where to start. Many people are looking for this advice right now as people are facing these uncertain times. These are good tips, definitely worth sharing.

Thanks Nadia! Yes, better late than never when it comes to investing.

Thanks for this informative post! I used to have stocks but I moved to another country and everything is new to me. This is a good post for me learn how to start over again.

Thanks Kathlee!

Getting locked in and committed to the #5 on the list is in my option the most important thing! You need to not be agonizing over the market every day if you went against your gut feeling. You need to be comfortable and confident!

Thanks Kari!

Thanks for this. I think I’ll turn a new leaf an use the tips mentioned above

Thanks Favour!

Pingback: Stocks vs. Bonds - How to invest your money smartly?

Pingback: 10 Popular Passive Income Ideas For Your Financial Freedom

Enjoyed your list. I liked that you started your list by highlighting simple financial literacy like attending to your own spending and budgeting as well as mindset; risk tolerance, goals, etc. This will be a helpful tool for your readers. I’ve written a similar post on finances in the past and I also start with mindset. Take care.

Thanks William!

I’m glad you mentioned that you should establish a budget and get your financial life in order before thinking about stocks. Investing in risky assets like individual stocks have great returns, but can also ruin the financially unprepared. The majority of investors (like 95%) should concentrate on mutual funds, target-date funds, or ETFs. Great, informative article!

Thanks Jennifer!

Great information, laid out really well- thanks!

Thanks Daphne