This article may contain affiliate links. I might earn a small commission if you make any purchases through my links and it comes at NO cost to you. For more information, please read my Disclaimer page.

Back in 2012, my wife and I decided that it was probably time to move on and buy something that we could call home.

We lived in the Boston area and the rent situation was through the roof year over year. The landlords knew the timing couldn’t be better as the economy was getting back on its feet after the 2008-2009 recession and it was time for them to push the envelope.

As the economy got better, so did the job market, so did the unemployment rate. As a result, people started spending more as they could afford more.

I remember that we paid approximately $1,200/month on average for a one-bedroom apartment for most of 2009-2010 and around $1,500/month by the end of 2012.

If we were to buy a home, it had to be in the suburbs and that meant moving out of the Boston area. We had a few friends already living in the burbs and were familiar with a few neighborhoods with good school districts and hence decided to consider those first.

In the beginning of 2013, we moved to a suburb and got a 2-bedroom apartment with a loft for $1,700/month (for only $200 more, we got additional 700 sq. ft and our apartment was huge)

Soon after moving, we sat down to chalk out a financial plan on how we were going to save and stick with 20% in down payment to buy our dream house. During those days, a typical 3 to a4-bedroom single-family home in a good school district and neighborhood would cost you around $500,000 on average in Massachusetts.

Both of us are NOT DIYers, and we were looking for something that was move-in ready (with a

So, here’s the process that we followed to save for down payment.

Process To Save And Stick To 20% Down Payment

Step 1: Have A Blueprint That You Agree With

Blueprint is a crucial piece of your 20% savings plan. The design should be detailed enough to call out the below 5 aspects at a minimum:

– Types of home you are looking for, bedrooms, bathrooms, garage space and any other preferences

– Move-in ready or fixer-upper

– Maximum budget $ that you are willing to spend

– Desired school districts and neighborhoods

– Commute to workplace

Download FREE Budget Checklist

>> 50+ List of Budget Items

>> Budget Items categorized into 3 sections: Income, Fixed Expenses, Variable Expenses

Step 2: Research

Before you can dive in to create a financial plan, it is essential to understand that doing the required and often the necessary research can save you from a lot of anxiety down the road. You should have a pretty good idea of how much it will cost for you to buy a property in your desired neighborhood that would closely match all those things called out in your blueprint.

This step is a significant step in the process that comes in extremely handy when you are looking at properties that are priced to sell, and you want it, so you do not blow up your budget.

Focus on the below for your initial research:

– Price points of move-in ready properties vs. fixer-uppers

– Selling prices of recently sold properties in the neighborhood (also called comps)

– Details about the type of layouts, square footage, upgrades, year built, water and sewer options, heating options to name a few of the properties recently sold

– Proximity to highways, malls, grocery shopping (as these would both save time in your daily routine and also come in handy during resale)

– Town/city safety and crime rate

Step 3: Create a Current LifeStyle Plan

Now that you have your Blueprint (your wish list) and the Research (a reality check of what is it going to cost), it is time to put the numbers together.

To begin with, you need to know where you stand as far as your current lifestyle is concerned. What does it take every month to run your household, income you make (from all sources), your expenses and the net amount you save.

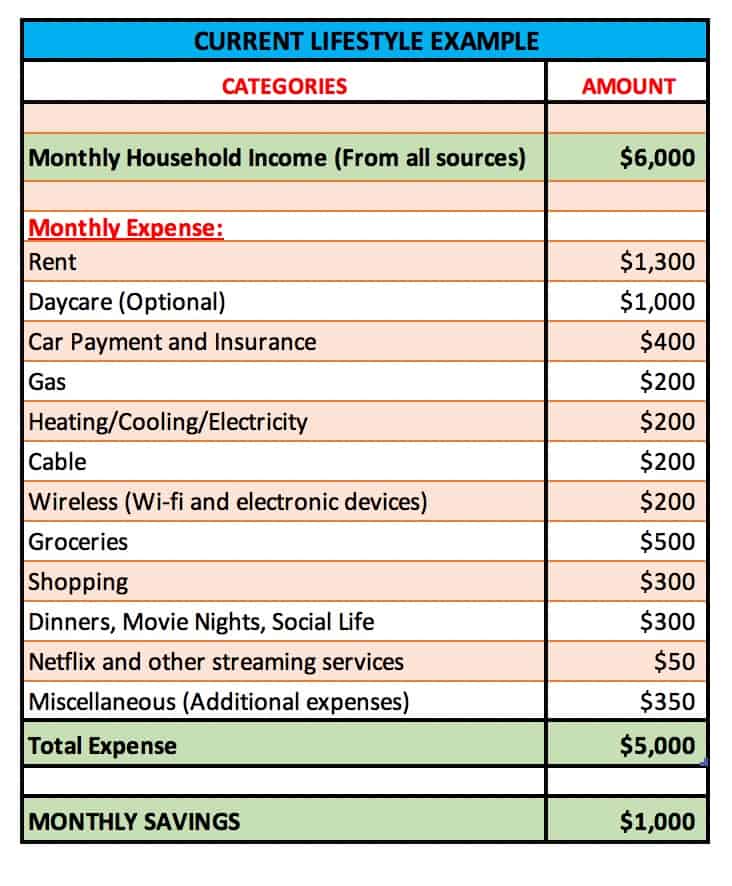

Let’s take a look at the below example that shows monthly household income and expenses:

As you can see in the above example, after everything is said and done, there are monthly savings of about $1,000.

Let’s assume that based on your blueprint and research, you want to buy a property in the range of $400,000 in Massachusetts.

This means that for 20% down payment you need to save $400,000 * 20% = $80,000.

At the current pace, with saving around $1,000/month, it is going to take about 7 years to reach your goal. Chances are, the property prices would be worth more in 7 years (barring a recession) which means your 20% down payment requirement will also be higher for the same blueprint. You will have to make some important adjustments to your current lifestyle to reduce that 7 years (if you wish to) down to say like 3-4 years (realistically).

Related Article: How To Save Money

Step 4: The Adjustment Phase – Your Action/Financial Plan

This is the phase where you get to choose your path, test your determination, and discipline and execute your game plan.

It doesn’t have to be daunting, boring, suck the fun out of life experience and all you need to make sure is to be realistic and focus on the execution to get to the finish line.

So, let’s assume we want to save $80,000 (from our example above) in 3-4 years.

First, look at your monthly expenses and identify the necessities (essential in daily life) and eliminate those. As a result, you can reduce the list of items you need to tackle.

We can safely eliminate (as you can’t live without) the below necessities:

–> Rent

–> Daycare (Optional)

–> Car Payment and Insurance

–> Gas

–> Heating/Cooling/Electricity

The revised expense list (one that provides an opportunity to find more savings) would now look like:

As you can see from Fig. 2 above, the revised list will leave you with around $1,900 of expenses that you can make adjustments to save for your dream home. That’s a good chunk of money to work with!

You can look at your cable and wireless plans and determine what you can downgrade to a lower package plan (with fewer cable channels and lower number of devices connected to your wi-fi plan)

Next, you can cut down on (not eliminate) your dinners outside, movie nights and other social life and shopping expenses. Remember, you do not need to eliminate any of your social aspects and live a dull and depressing life. All you need to do is dial it down to reach your goal.

For groceries, shop smart and look for coupons, buy family packs if available so you can cook more to substitute your dinner outside, reduce the junk food quantity and instead buy healthy food that you can eat during meals so you don’t have to order take-out. There is minimal savings opportunity here but it all adds up in the long term.

Download FREE Budget Checklist

>> 50+ List of Budget Items

>> Budget Items categorized into 3 sections: Income, Fixed Expenses, Variable Expenses

For monthly streaming subscriptions, ask yourself what can you live without based on your lifestyle and requirements. If you travel often, you might need Netflix but can find savings somewhere else. Focus on what is absolutely necessary and eliminate the rest.

The Miscellaneous bucket is for stuff like Gym membership, Sports activities and anything else not captured in the other buckets.

I want to re-emphasize – the adjustment phase is not a punishment but rather an exercise that will personally test you. It is an eye-opener regarding the stuff you do not need.

Trust me; I was amazed at all the things I use to buy and spend money on that I was able to live without once I got my act together.

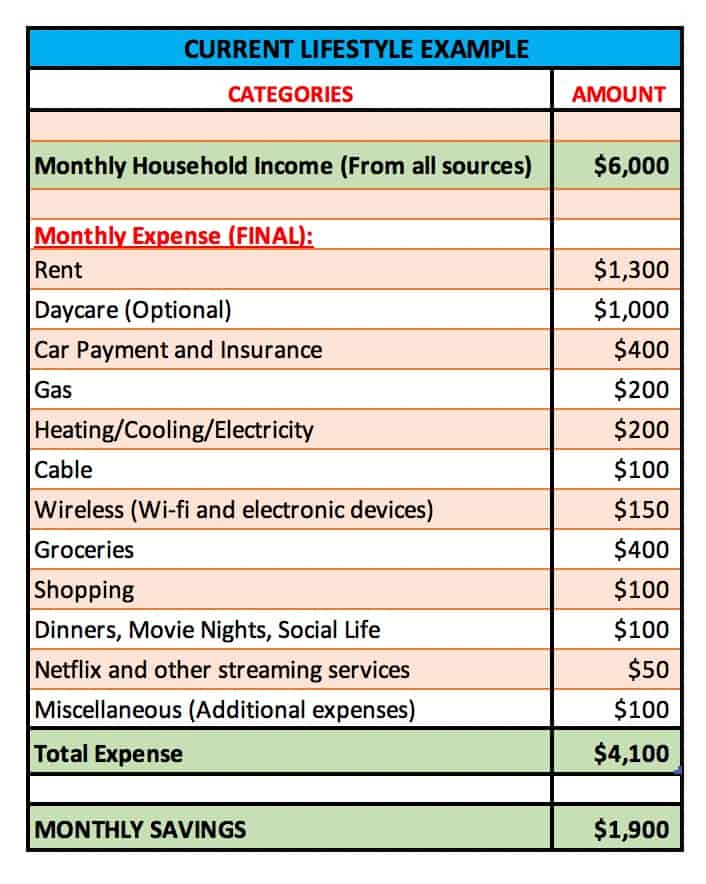

Your reduced expense categories might look like:

Step 5: The End Result

Out of the pool of $1,900 (fig. 2), if you are able to reduce your expenses by approximately half, you end up with an additional $900 ($1,900 – $1,000) toward savings.

That puts you at $1,000 (initial) + $900 (additional) = $1,900 in TOTAL monthly savings (32% of your monthly household income!)

Your initial 7-year timeline is NOW down to AROUND 3.5 years!

Your FINAL list might look like:

Please note that I have not considered yearly salary increases, promotions, yearly bonuses, or any other source of income that is an outlier (one-timer). Also, the daycare expense is optional so if you do not have that, you have another chunk you can add to your savings.

If you exclude the daycare option, this will bring you UNDER 3 years of the timeline to save 20% in down payment for your dream home!

The above example is just for illustrative purposes and it will vary depending on where you live, income levels, property prices, and other factors, but the framework and process do not vary.

We followed a similar process and at the end of 2014 bought our first home in the desired neighborhood with 20% down!

Final Thoughts

The biggest point to drive home is that if you have a clear vision of where you are currently in terms of your finances and where you want to be (along with an actionable plan), achieving the end goal is not rocket science. If you execute your plan, you can save for down payment.

Focus on your blueprint, research and action/financial plan and I believe, you will be able to save 20% in down payment for your dream home!

Download FREE Budget Checklist

>> 50+ List of Budget Items

>> Budget Items categorized into 3 sections: Income, Fixed Expenses, Variable Expenses

What has been your experience? Please share your thoughts and experiences in the comments section below!

I’m impressed with your story and your website. I hope it inspires others to follow your lead. I have 325 clients and many of them complain that their grown children are not saving money. Since company pensions are gone, except for government pensions, and social security is in poor shape, a lot of my clients worry about their children’s financial future – especially with mounting student debt and generation Xers changing jobs so frequently.

In my case, my wife and I each have government pensions. However, I am semi-retired since I still do some teaching and have an income tax business. We are very comfortable with our finances since our house and cars are paid off, but I used to worry about money up until age 50 since my parents were not wealthy and my wife and I raised four kids. As you point out, it takes some good budgeting and hard work but it pays off in the long run.

Since federal income tax changes were significant in 2018, this impacts financial plans and it creates some opportunities for your readers and I think this could be a good issue in a future article.

Thanks for your comment! Paying off Student debt is a huge issue (something I went through too) and the sooner you pay off the better. Having the focus and discipline to save money will make paying off the debt easier.

Pingback: How To Create An Emergency Fund: A Proactive vs. Reactive Approach

Pingback: Money Mistakes To Avoid: 10+ Common Money Mistakes

Hiya!

I am a fellow EBA student and that’s how I found your site! I love this post and anything to do with property really.

Great job for securing your home for your family and wishing you all the best!

Thanks Corinne. Appreciate the kind words!

Great tips. My husband and I followed a similar plan back when we bought our first home in a hot market and it certainly paid off for us in the long run because we found we tend to live more frugally now since we saw how quickly we could save.

That’s awesome Katy! Thanks!

Good info!! More people should read this. Thank you for sharing.

Thanks Holly for the kind words!

This is such an important topic when it comes to budgeting and most people ignore it. Having 20% down seems like a big number but the benefits are long term and it is very easy to pay off the mortgage debt when you have already paid off a big chunk in the form of down payment. We did it and we were able to pay off our mortgage in under 4 years. The tips you have provided are all actionable and if done correctly, it can bring financial independence and debt free life.

Absolutely Nadia! 20% down payment can go a long way in helping you pay off your mortgage quicker! Congrats on paying off your mortgage!

Great ideas whether you’re wanting a down payment or are trying to pay off your house. Seems like many people are trying to get on top of their finances these days and that is a good thing!

Thanks Carri and agree it’s a great thing to take charge of your finances!

Researching multiple desired neighborhoods is key, especially if they have HOA fees as those can be pretty steep!

So true Kari. Thanks!

This is great information and I’m in that phase of saving that 20% for a new house. It is really hard with the economy to save that much money but this post helped me map it out a bit. I’m just going to have to adjust my current lifestyle.

Great to hear you found it helpful Heather!